Retail Council of Canada (RCC) and Moneris® Data Services have teamed up to provide the retail industry with Canadian credit and debit spending data and consumer insights that will help the industry more easily identify consumer behaviour and spending trends at the national and provincial level.

Each quarter, Retail Council of Canada surveys executive members from mid-large sized retailers from coast to coast to obtain an insider’s perspective on retail performance for the past quarter. RCC does not present the results as a statistically representative analysis but rather a retail pulse to help provide context around trends impacting the industry. Respondents from the gas, motor vehicles or grocery sectors are not included in the survey.

The following commentary is an excerpt of the report covering the period of June-September 2024.

Overview

The song remains the same: Financially stretched consumers continued their focus on what they deemed essentials over the summer, and with a few exceptions, the flight to value that retailers reported during the first half of the year turned into a stampede. Retailers relentlessly focusing on a strong customer value proposition, either expressed in an economic value position or a remarkable unique value proposition, did better than others.

Several consecutive Bank of Canada minor interest rate cuts have not impacted the trajectory of customer discretionary spending. Retailers report the Back- To-School retail event was more of a non-event in terms of year-over-year gains. Retailers report that driving traffic to their stores or websites is challenging, with several telling us that even with aggressive sales events, they are hardly making a dent in traffic. The good news is that margins are in pretty good shape, as are inventories, as retailers expected a soft summer and had planned accordingly. It also seems that when customers are in the store, they buy, so conversion is good.

Supply chain disruption discussions were at the executive table all summer. We are nowhere near the level of disruption as the COVID era. Still, between threatened rail labour disputes starting in the spring, potential fall Vancouver port strikes and (now averted) Air Canada labour stoppages, these self-inflicted wounds on Canada’s business economy are not welcomed.

Respondent insights for June to September MTD

- For the whole summer, 83% reported sales down from last year

- 69% forecasting 2024 will be down to last year

- Margin percentage up for 50%, margin dollars down for 67% (August)

- Inventory levels down for 50%, turns up for 76% (August)

- Tickets down for 56%, baskets flat for 43% and up for 29% (August)

- Web sales down for 76% (August)

Sales

A sizable majority of respondents, 83%, reported their summer sales were down year-over-year. Most, 69%, anticipated ending 2024 below last year in sales. For most of those reporting a year-over-year decrease in sales, the bottom is not dropping out of the market – growth is just very hard to come by.

The Retail Conditions Report captures respondents' views and experiences across diverse categories (excluding grocery, gas, and auto.

RBC reported that the appetite for discretionary goods remains limited, and that July saw a broad-based spending decline, including decreases in spending on clothing, groceries and gasoline. On gasoline, average prices across the country are equal to or even favourable compared to last year, which should be positive for retail spending, but is not translating into any discretionary spending lifts, or incremental recreational travel.

Gain actionable insights with access to real-time Canadian consumer spending and location data with Moneris Data Services. Learn more.

Most retailers see little upside for the back half and, in fact, weakness into 2025. They expect consumers to continue to shop, spend and celebrate the seasons, but not come anywhere near making up for any shortcomings with a super strong holiday retail season.

When asked about Black Friday /Cyber Monday plans for 2024, most retailers stated it was business as usual and that there were no major deviations from prior years. This perspective comes with experience: for many, sales and promotions did not drive the expected traffic or sales life, so while they were more than ready to compete for Black Friday, there were few incremental plans or strategies.

Customer Behaviour

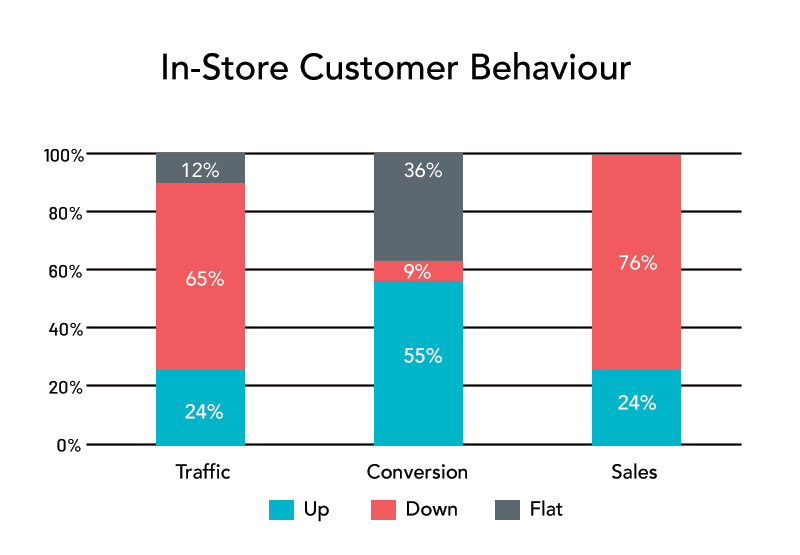

Retailers continue to report that traffic and sales within their stores are soft year-over-year, with 65% of retailers telling us traffic was down versus last year. They also said that traditional promotional activities to drive incremental traffic (sales or discounts), are not very effective. Unconventional promotional activities can break through the clutter, but not necessarily the reluctance to shop and buy once they cross the lease line.

Most report the Back-To-School retail season was flat to down, but on the positive side, the Labour Day long weekend had a bit of “pop” to it. An interesting paradox mentioned by several retailers was that when interest rate increases were happening regularly, they witnessed an almost immediate impact on sale the next day and the remaining week.

Unfortunately, the same has not been valid for interest rate decreases. Perhaps the interest rate cuts are too small to break through the consumer value psyche. The cumulative effect of more decreases may break through. For those renewing their mortgage this year or in 2025, the rates are still significantly higher, resulting in higher monthly payments. Record high rents are not impacted by interest rate cuts, at least in the short term - only an increase in rental apartment stock will impact rents. Overall, as one retailer told us, this has become a change management exercise - consumers will need a lot of incentives to break out of their value-conscious shopping ways.

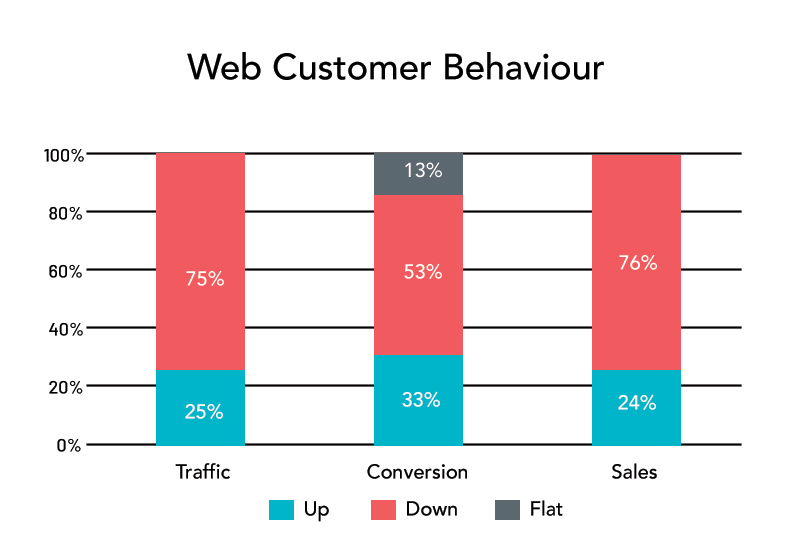

Web sales were down for 76% of respondents, compared to 47% of respondents in April. Traffic as well was down significantly, with conversion being up for only 33% of retailers. For those with increased sales and traffic, we heard of the benefits of new, better integrated eCommerce platforms.

Retailers and AI- One Year Later

A year ago, when we asked retailers about their thoughts on the impact of AI on their business, there was a broad spectrum of responses, from somewhat skeptical (we've heard this before with many technologies that have come and gone) to really engaged and actively using AI already.

When asked if they were more, less, or equally excited about the opportunity for AI to impact their business versus a year ago, the majority were as excited today as they were a year ago.

From an organizational perspective, most retailers have their existing teams learn and use AI, with a few having dedicated AI subject matter experts, analysts, or technologists. There is a positive work culture impact, with teams getting to do exciting things with new and exciting technologies. It also helps manage the concerns over people being replaced by AI.

About Retail Council of Canada

Retail is Canada’s largest private-sector employer with over 2 million Canadians working in our industry. The sector annually generates over $78 billion in total compensation. Core retail sales (excluding vehicles and gasoline) were over $433B in 2021. Retail Council of Canada (RCC) members represent more than two-thirds of core retail sales in the country. RCC is a not-for-profit industry-funded association that represents small, medium, and large retail businesses in every community across the country. As the Voice of Retail™ in Canada, we proudly represent more than 45,000 storefronts in all retail formats, including department, grocery, specialty, discount, independent retailers, and online merchants. www.retailcouncil.org.

Contact:

Santo Ligotti

Vice President, Marketing and Member Services

RETAIL COUNCIL OF CANADA | CONSEIL CANADIEN DU COMMERCE DE DÉTAIL

[email protected]

Interested in membership, then please visit retailcouncil.org or contact [email protected]

Share