As part of our latest partnership with the Conference Board of Canada we are pleased to present the following authoritative insights from their Index of Consumer Spending (ICS) which has been Powered by Moneris® Data Services. Our industry-leading consumer spending data and insights from point-of-sale activity combined with The Conference Board of Canada’s expertise provides a coast-to-coast perspective on how the economy is trending.

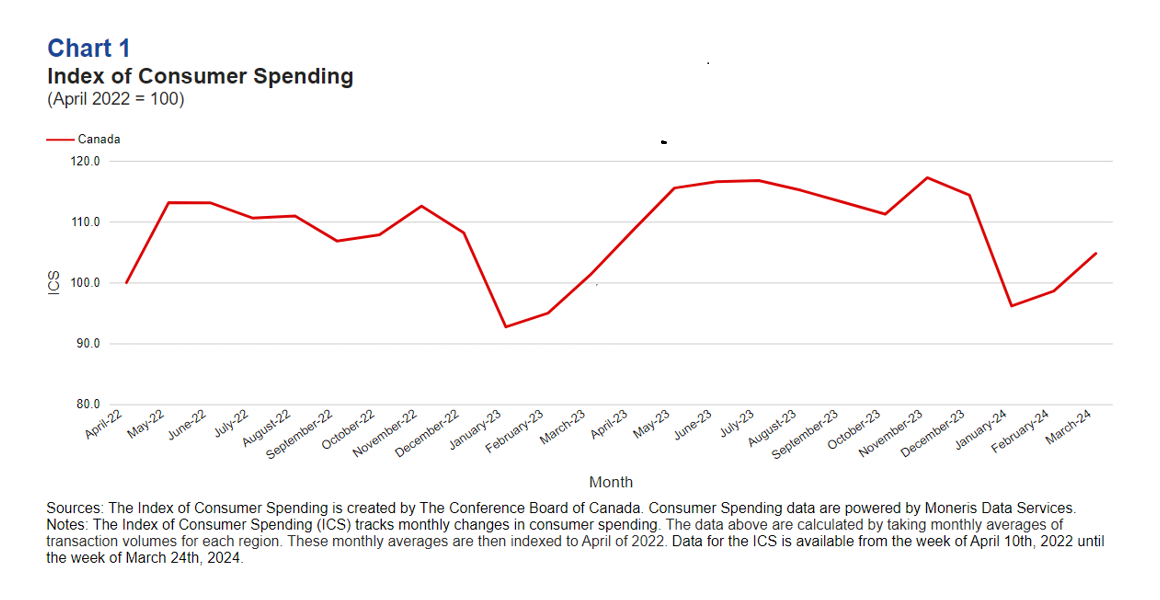

- The Index of Consumer Spending (ICS) averaged 99.8 points in Q1 2024, compared to 114.3 points in Q4 2023. Year-over-year Q1 2024 averaged 3.5 points higher.

- On a month-to-month basis, the ICS slid to 96.1 in January 2024, falling 18.2 points from December 2023, before climbing to 98.6 points in February, and 104.8 points in March.

- A drop in consumer spending at the start of the year was not unexpected as the index is not adjusted for seasonality. The dip in spending follows normal trends where higher consumer spending from the holiday season generally tapers off at the beginning of the new year.

- The Bank of Canada continued to hold its policy interest rate steady at 5.0 per cent throughout the first quarter.

- The consumer price index (CPI) for Q1 stayed within the Bank of Canada’s “control range” of 1-3 per cent. In January, the year-over-year CPI came in at 2.9 per cent, dropped to 2.8 per cent in February, and then inched back up to 2.9 per cent for March.

- Canada continues to have strong population growth, which is helping maintain spending levels. On January 1, 2024, Canada’s estimated population sat at 40,769,890 people. As of April 17, 2024, Canada’s estimated population stands above 41 million people.

Gain actionable insights with access to real-time Canadian consumer spending and location data with Moneris Data Services. Learn more.

Key Insights

A weakening labour market is expected to apply downward pressure on consumer spending.

To date, strong wage growth across Canada has likely helped maintain some spending. On a year-over-year basis, average hourly wages were up 5.3 per cent in January, 5.0 per cent in February, and 5.1 per cent in March. This growth, however, is expected to face some downward pressure alongside an easing in labour market conditions. The monthly employment rate has been steadily dropping since October 2023, while the unemployment rate has creeped upwards hitting 6.1 per cent in March 2024. The number of unemployed people has risen dramatically to 1.3 million in March (23.0 per cent higher compared to the same time last year). Job vacancies have also declined, reflecting reduced production needs to satisfy consumer demand.

Pent up demand for housing in Canada may have been a factor that contributed to the limited spending in the first quarter

The Bank of Canada’s 2024 Q1 survey of consumer expectations showed a greater share of survey respondents (14.98 per cent) in Q1 are planning to purchase a home in the coming year compared to the average (13.08 per cent) from the year prior. Those preparing to purchase a home in the near future likely reined in their spending and allocated more of their income towards savings. Some of this restrained spending, however, may begin to be released later this year when interest rates start to come down. The Conference Board of Canada expects the Bank of Canada’s first rate cut to happen in mid-2024. Rates are expected to continue being trimmed for the remainder of the year and into 2025.

About The Conference Board of Canada:

The Conference Board of Canada is the country’s leading independent research organization. Our mission is to empower and inspire leaders to build a stronger future for all Canadians through our trusted research and unparalleled connections. Index of Consumer Spending | The Conference Board of Canada.

Media Contacts:

The Conference Board of Canada

[email protected] / 613-526-3090 ext. 224

[email protected] / 416-734-1442

Walter Bolduc

Economist

[email protected]

Share