Real-time ecommerce payments can lead to real-time cyber risks. As consumers embrace online shopping, which is forecasted to account for 10% of total retail sales in Canada in 2020, businesses must update their fraud prevention strategies. It's particularly crucial if you are a small business owner, as offenders are more likely to be successful in getting through your line of defence.

Fraudsters are continually evolving and shifting tactics, so the most effective solution is to learn how to layer your fraud prevention tools. By implementing a multi-layer fraud management strategy, you can reduce risk, decrease losses, and retain revenue. In a nutshell, it allows you to combine complimentary fraud prevention tools that, when working in tandem, offer you complete control and ensure comprehensive protection.

The effectiveness of this strategy lies in implementing the right fraud tools that address various risks for your online business. That's why Moneris offers a range of online tools that offers businesses everything from web services to fraud protection.

An overview of Moneris’ online fraud tools

With stolen credit card information, identity theft, and chargeback fraud, there are several ways fraudsters can target your ecommerce businesses. A great way to help prevent fraud from hurting your online sales is to use the multi-layered approach so that one tool complements another. So, what are some of these tools?

Standard tools

Card Verification Value (CVV)

A solution for online processing that validates the 3-4 digit code on the customer's credit card with the issuing card bank.

Address Verification Service (AVS)

Matches the billing address the customer provided to the address on the record with the issuing card bank.

Advanced tools

3-D Secure

3-D Secure provides real-time authentication of an online shopper to their card issuer through Visa Secure, MasterCard Identity Check, and American Express SafeKey1.

Moneris Kount® Essential

An out-of-the-box solution that uses predetermined risk parameters based on your business size and industry to assess potentially fraudulent transactions in real-time. Learn how you can take advantage of Kount Essential for your ecommerce business (link to the first article).

Moneris Kount® Enterprise

A comprehensive solution designed for businesses looking to reduce fraud exposure by customizing specific rules to accommodate risk tolerance levels and strategically assess transaction risk in real-time.

Card Tokenization

Tokenization replaces credit card details with a unique identifier (the token) that remains stored in the Moneris Vault. Tokens can be shared across your business for subsequent transactions online and at the point-of-sale. Since you don't have to store card data, security is that much stronger.

Hosted Tokenization (HT)

For online businesses that prefer not to handle card numbers directly, the card data is collected by Moneris on your behalf. A token is returned to complete the online transaction.

Vault

Our Vault resides on the Moneris Gateway to securely store data, including tokens and customer information. You can create customer profiles for future transactions and update customer records in real-time.

When one solution isn’t enough

Whether you do business online or over the phone, security is an urgent priority. When you process payments with Moneris, you can get access to tools and programs that help prevent fraud and ensure that your business is protected. For many ecommerce businesses, one tool may not be able to provide the overall protection and may require multi-layered protection instead. These issues can include:

Scalability

If your business is growing fast, your full attention may be on streamlining your operations rather than fraud prevention. The world of ecommerce is important for independent businesses to enter, but with it comes the risk of fraudulent transactions that are harder to identify versus in-store activity. Using one tool may not be useful when it comes to growth, so integrating other solutions can help boost efficiency without too much disruption.

Card tokenization, for example, maybe a great addition if you have a physical location and an ecommerce store since you share the token for the following online and in-store transactions. You also don't have to worry about storing customer information and breaches since the data is stored in the Moneris Vault.

Previous exposure

Perhaps your ecommerce store had been vulnerable to fraud, or you're looking for ways to prevent chargebacks from happening again, so you're reconsidering your line of defence. Instead of rebuilding your fraud prevention strategy from scratch, you can add an advanced tool like 3-D Secure on top of CVV and AVS.

Using risk assessment technology to authenticate online shoppers in the background, 3-D Secure only challenges cardholders to authenticate themselves if they have a higher risk profile. The additional security layer helps prevent unauthorized card-not-present transactions and protects your business from fraud.

Manual reviews

With great success comes greater risks, and for businesses with high processing volume, manually reviewing your data is challenging. You can layer in Moneris Kount on top of other tools to approve or decline transactions, either using our pre-configured Moneris rule-set or the rule-set you have created with Kount. This solution generates a numeric risk score and enables a friction-free checkout with an average response time of 300 milliseconds.

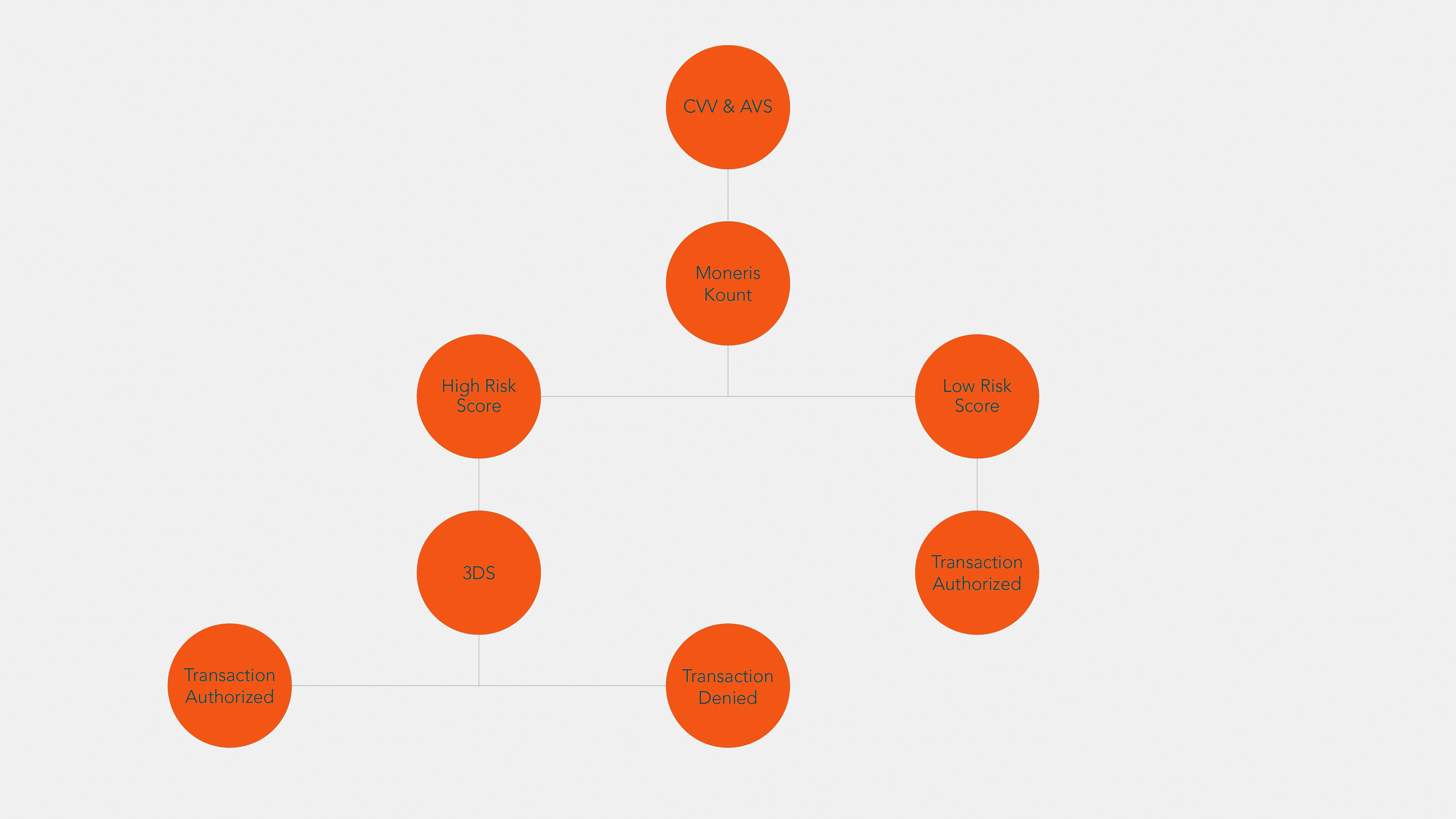

How multi-layered fraud prevention works

Your fraud prevention strategy should be powerful enough to protect your business against real-time online fraud. It should be a complete end-to-end solution that minimizes losses and improve your bottom line.

Each business may require a unique solution for overall protection. Still, in any case, it will start with your primary set of tools. These tools will be your fraud protection center, where you can integrate extra tools to build a robust solution. Let's consider the following example:

With CVV and AVS as your core fraud protection tools, you can perform a card verification request, which will verify the validity of the credit card as well as the CVV and address information that the issuing bank has on file for your customer. You can then send a Moneris Kount risk inquiry for a real-time risk assessment. Moneris Kount uses information from billions of purchase attempts to generate a numeric risk score for the transaction.

If the transaction is deemed to be of low risk, you can decide to send a purchase request. If the risk score is high, then you can choose to route through 3-D Secure to obtain chargeback liability protection for this transaction that Kount has deemed risky.

This strategy is just an example of the many ways your business can implement fraud prevention tools. Moneris Checkout has implemented a fraud prevention strategy using all of our tools, so you can protect your business with real-time solutions that reduce chargeback and minimize losses.

Create an effective fraud prevention strategy

It's clear that now is the time for online businesses to have a clear plan in place to defend against fraud. Consider the following key elements that will help you create a fraud strategy:

- Each business is different, so it's essential to work with your payment processor to develop a specific plan for your risk exposure.

- Implement and layer the right tools to minimize risk.

- Consider enhancing your business practices and other ways of keeping your business protected from fraud all year long. Understanding the general habits and shopping patterns of your customers can help identify irregular activities. Consider setting restrictions on the total purchase amount based on your average order value and revenue trends.

- Create guidelines to analyze and respond to successful fraud attempts. Continuously monitor sources to identify trends and prevent repeat attempts.

One of the most effective ways to keep on top of fraud threats and protect your customers' sensitive data is by layering your fraud prevention tools. Solutions that take advantage of machine learning and artificial intelligence, like Moneris Kount, can help to strengthen your infrastructure and reduce ecommerce fraud. Since there isn't a single combination of solutions, small business owners must devise a customized plan that addresses your business's risk exposure.

1 Only applies to merchants who have an AMEX OFI merchant number. Not available for merchants who have be boarded through the Opt-Blue program.

The information in this article is provided solely for informational purposes and is not intended to be legal, business or other professional advice or an endorsement of any of the websites or services listed.

Share