Swipe, tap and thrive: Why every single-location restaurant needs a POS

Learn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

Debit card machines, also known as point-of-sale (POS) terminals, facilitate electronic payment transactions. When a customer chooses to pay with a debit card, these machines play a pivotal role in authorizing and processing the payment. This process involves several key components, from the physical interface of the machine to the complex networks that ensure secure transactions.

Debit card machines, integral to both personal and business transactions in our digital age, function through a meticulously organized process to ensure each payment is secure and accurate. Let's delve deeper into each step of how these machines process a typical debit card transaction.

The transaction begins the moment a customer presents their debit card to make a payment. Depending on the technology available, the card can be swiped (magnetic stripe), inserted (chip), or tapped (contactless) on the machine.

Once the card details are captured, the debit card machine packages this information with the transaction amount and sends it to the merchant's bank or payment processor. This transmission is safeguarded through encryption, ensuring that sensitive information is securely converted into a format that only the receiving bank's system can decrypt.

Connection Types: Depending on the machine's setup and the available infrastructure, this data can be transmitted through various channels, including traditional phone lines, internet connections, or wireless networks via cellular data.

Upon receiving the transaction data, the merchant’s bank forwards this information to the cardholder’s bank (also known as the issuing bank). The issuing bank then performs several checks:

After these checks, the issuing bank either approves or denies the transaction, sending back a corresponding authorization code to the merchant’s bank, which is then relayed back to the debit card machine.

Throughout this process, each step is designed to maximize security and efficiency. Encryption, unique transaction codes, and real-time data transmission help protect against potential fraud and ensure that the transaction is smooth and the user experience is positive.

Understanding the detailed operations of debit card machines helps both consumers and merchants appreciate the complexity and effectiveness of modern electronic payment systems, ensuring trust and reliance on these technologies for daily transactions.

Security is a top priority in the functioning of debit card machines. Here are some of the security measures implemented:

Debit card machines offer a quick and easy way to make payments without the need for cash.

Enhanced security features reduce the risk of fraud, providing peace of mind when making transactions.

With the widespread availability of debit card machines, consumers can make transactions at a multitude of locations worldwide.

By accepting debit cards, businesses can cater to more customers who prefer not to carry cash.

Transactions are processed quickly, which can lead to faster customer service and turnover.

Electronic transactions provide an automatic record of sales, aiding in financial tracking and inventory management.

Debit card machines are integral to modern financial transactions, providing a bridge between digital banking capabilities and physical point-of-sale interactions. Understanding how these machines work not only demystifies the process but also highlights the importance of secure, efficient payment methods in today’s economy. Whether for personal use or business applications, these machines ensure transactions are executed swiftly and securely, reinforcing the infrastructure of electronic commerce and finance.

Learn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

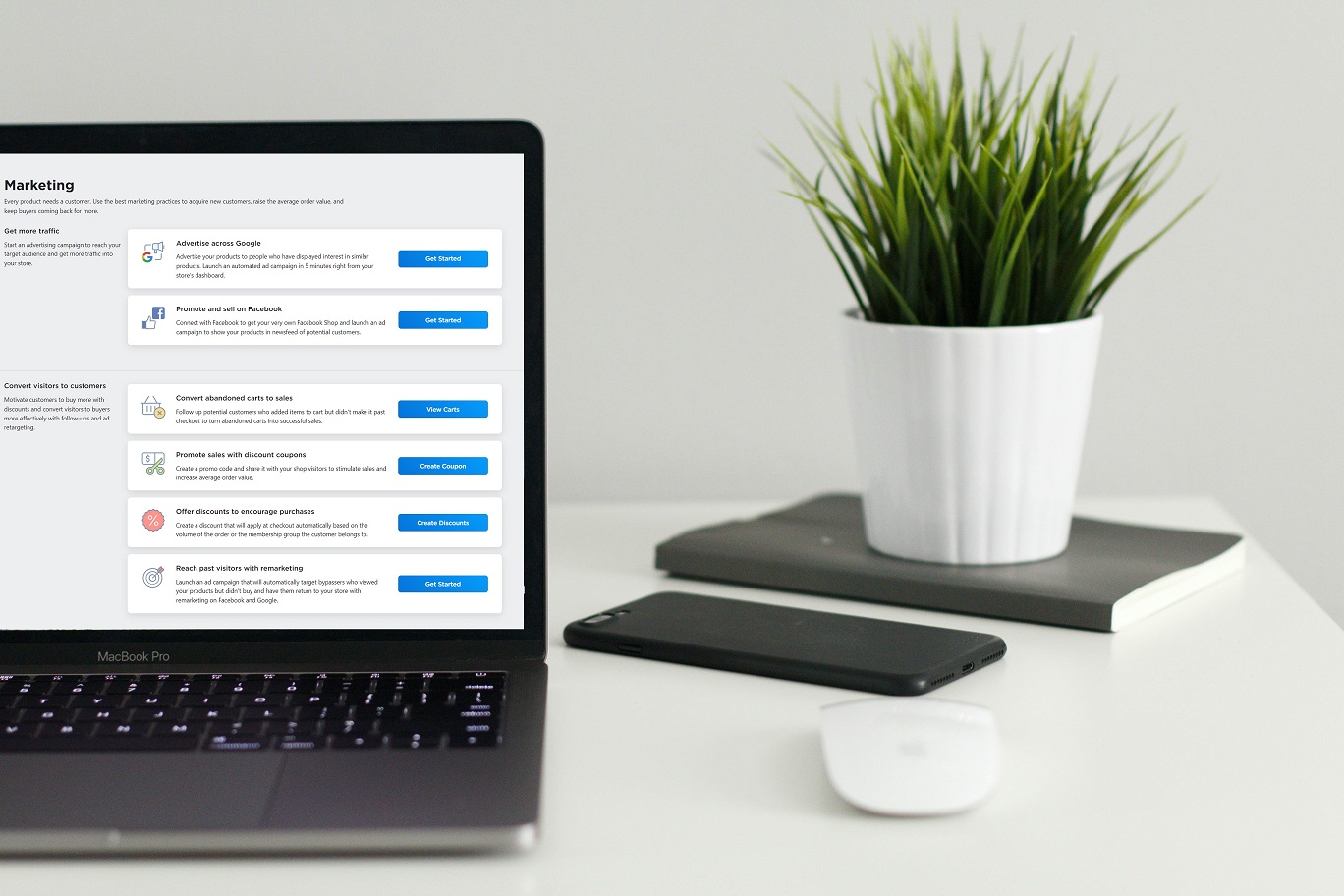

While an optimized ecommerce store is essential for selling your products, you still need a good marketing plan to get your online business off the ground.

Discover the best POS systems for small retail businesses. Learn how to streamline inventory, boost sales, and improve customer service with the right POS solution.

Learn what card testing fraud is, how it targets your e-commerce site, and the best practices you can use to detect, block, and prevent attacks before they impact your business.