Swipe, tap and thrive: Why every single-location restaurant needs a POS

Learn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

Contactless payment is a secure method allowing customers to make payments by simply tapping a contactless card, smartphone, or other NFC-enabled devices against a payment terminal. This technology uses near-field communication (NFC) to establish a connection between the payment device and the terminal, making transactions swift and effortless.

Contactless payments, once a novelty limited to fast transactions in sectors like public transit and retail, have become a mainstay across a broad spectrum of industries. This shift reflects a significant evolution in payment technology, emphasizing speed, convenience, and the ever-growing demand for safer, touch-free interactions—qualities that became particularly crucial amid global health concerns.

Initially, contactless payment technology was embraced for its simplicity and speed, facilitating small transactions efficiently. The technology uses NFC (Near Field Communication) to allow a secure and quick payment process by simply tapping a card or a smartphone over a payment terminal. This method significantly reduces the transaction time compared to traditional swiping or chip-insert methods.

The adoption of contactless payments saw a dramatic increase as a result of the COVID-19 pandemic. With health and safety becoming paramount, both businesses and consumers sought ways to minimize physical contact. This led to an accelerated shift from cash and traditional card payments to contactless alternatives, not only in everyday retail but also in sectors like hospitality, healthcare, and services.

Technological advancements have played a crucial role in the widespread adoption of contactless payments. Innovations such as mobile wallets (e.g., Apple Pay, Google Wallet) and enhanced security features like tokenization and encryption have helped increase trust among users. These technologies protect personal financial information by replacing it with a digital identifier or token, making contactless payments not just convenient but also secure.

For businesses, the shift to contactless payments has meant more than just installing new hardware. It has led to a transformation in how they manage transactions and customer interactions. The efficiency of contactless payments can lead to reduced queues and faster service, translating into better customer satisfaction and potentially increased sales. Moreover, the data generated from contactless transactions can provide valuable insights into consumer behavior, helping businesses tailor their services and marketing strategies more effectively.

Looking forward, the trajectory of contactless payments is likely to continue upward, driven by further innovations in payment technology and a growing consumer preference for convenience and safety. The integration of contactless technology into wearable devices, and potentially biometric payment methods, suggests that the future of contactless payments will keep expanding its boundaries, making transactions more integrated into the fabric of daily life.

The ongoing evolution of contactless payments represents a significant leap forward in the quest for more efficient and secure transaction methods, proving indispensable for businesses aiming to stay relevant in a rapidly changing economic landscape. As we move forward, the role of such technologies will undoubtedly grow, further embedding into various aspects of commerce and personal finance.

Contactless payment is a method that allows customers to make payments using contactless technology, which typically involves Near Field Communication (NFC). This technology enables a secure, quick transaction process without needing to physically swipe or insert a card into a payment terminal. Here’s a step-by-step breakdown of how contactless payments work:

Contactless Cards and Devices: These contain an embedded NFC chip and antenna that allow them to communicate with contactless-enabled payment terminals. The same technology is also integrated into smartphones and wearables, enabling them through mobile wallets like Apple Pay, Google Pay, and Samsung Pay.

When you approach a payment terminal to make a transaction, the terminal is already configured to detect and communicate with NFC devices. The terminal continuously sends out electromagnetic fields that can power the NFC chip of a nearby contactless device.

To make a payment, you simply hold or tap your contactless card, smartphone, or wearable device close to the contactless symbol on the payment terminal. The NFC-enabled device must be within a few centimeters of the terminal to ensure secure communication.

Once the device is close enough, the NFC chip in the card or device is powered by the electromagnetic field from the terminal. It then transmits payment data (including account information and transaction details) securely. This data is encrypted and often includes tokenization, where sensitive data is replaced with a unique digital identifier.

The payment terminal receives the transmitted data and processes the transaction. It checks with the bank or payment network to verify the funds and approve the transaction. This process is quick, typically taking just a few seconds.

Once approved, the transaction is completed, and the terminal usually displays a confirmation message or signal indicating that the payment was successful.

Encryption: All communication between the contactless device and the terminal is encrypted, similar to EMV chip transactions.

Tokenization: Many systems replace your card details with a one-time code or token during the transaction. This means even if the transaction data is intercepted, it would be useless for any further transactions.

To enhance security, contactless payments are often subject to a transaction limit. For purchases above this limit, you may be required to enter a PIN or sign a receipt.

This seamless integration of advanced technologies ensures that contactless payments are not only convenient but also secure, providing a user-friendly payment experience that meets modern security standards.

Yes, contactless payments are generally considered safe. They use a technology called Near Field Communication (NFC), which allows for encrypted data to be transmitted securely between the payment terminal and your contactless card or device. Here are a few reasons why contactless payments are safe:

Overall, while no payment method is entirely risk-free, contactless payments offer strong security features that minimize the risk of fraud.

Yes, contactless payments are generally considered safer than traditional chip-and-PIN transactions for several reasons:

Reduced Physical Contact: Contactless payments minimize the need to physically touch the payment terminals, which is particularly beneficial in reducing the risk of transferring pathogens. This feature became especially valued during health crises like the COVID-19 pandemic.

Encryption and Tokenization: Like chip transactions, contactless payments use advanced encryption technologies. However, contactless payments often incorporate tokenization, where a one-time code is used for the transaction instead of your actual card number. This means that even if the transaction data is intercepted, it cannot be used again, thereby reducing the risk of fraud.

Short Range Communication: The NFC technology used in contactless payments only works at a very short range (typically 4 cm or less). This limited range helps prevent unauthorized interception of the digital communication between the contactless card and the payment terminal.

No Need for PIN Entry: For small transactions, contactless payments do not usually require a PIN or signature. This lack of a PIN entry reduces the risk of PIN theft, which is a common method used to compromise chip-and-PIN cards.

Transaction Limits: Most financial institutions impose limits on the value of contactless transactions to mitigate the risk of large fraudulent transactions. If the amount exceeds a certain threshold, the payment terminal will require a PIN or signature, thus providing an additional layer of security.

Fast Transaction Times: The quick processing time of contactless payments reduces the window in which data interception could occur, compared to the longer duration when inserting a chip card.

While both methods are secure and incorporate advanced encryption standards, the additional features of contactless payments—like tokenization and the inherent advantages of its technology—offer robust defenses against certain types of fraud. However, as with any payment method, maintaining vigilance over your financial transactions and regularly checking your statements are key practices for safeguarding your financial information.

Contactless payments process significantly faster than traditional methods, effectively reducing queue times and improving throughput during peak business hours. This efficiency is crucial for enhancing customer experience and satisfaction.

Using advanced encryption and tokenization, contactless payments offer robust security, reducing the risk of data theft and fraud. Each transaction generates a unique, one-time code, increasing security over transactions with magnetic stripe cards.

In response to health and safety concerns, contactless payments offer a preferable alternative, minimizing physical contact and promoting a healthier transaction environment. This aspect was particularly highlighted during the COVID-19 pandemic, where minimizing contact was essential.

While the shift to contactless payments is advantageous, it does come with challenges such as the initial setup cost and the need to upgrade existing systems. However, the long-term benefits—increased efficiency, enhanced customer service, and improved safety—often outweigh these initial investments.

Contactless payments significantly speed up transaction times compared to traditional methods, reducing queues and enhancing customer satisfaction with their swift, effortless processing.

These payments utilize advanced encryption and tokenization technologies, making them more secure than traditional payment methods by protecting sensitive information and reducing the risk of fraud.

The minimal physical contact required for contactless payments addresses hygiene concerns, an advantage that became particularly significant during health crises like the COVID-19 pandemic.

Originally popular in sectors like retail and public transit, contactless payments have expanded across various industries due to their ability to offer a safer, touch-free payment experience.

With ongoing technological advancements and increasing consumer preference for convenience and safety, the use of contactless payments is expected to grow, integrating further into daily transactions and possibly extending to wearable devices and biometrics.

Learn why a POS system is essential for small quick service restaurants and which features help streamline orders, boost sales, and keep your café running smoothly.

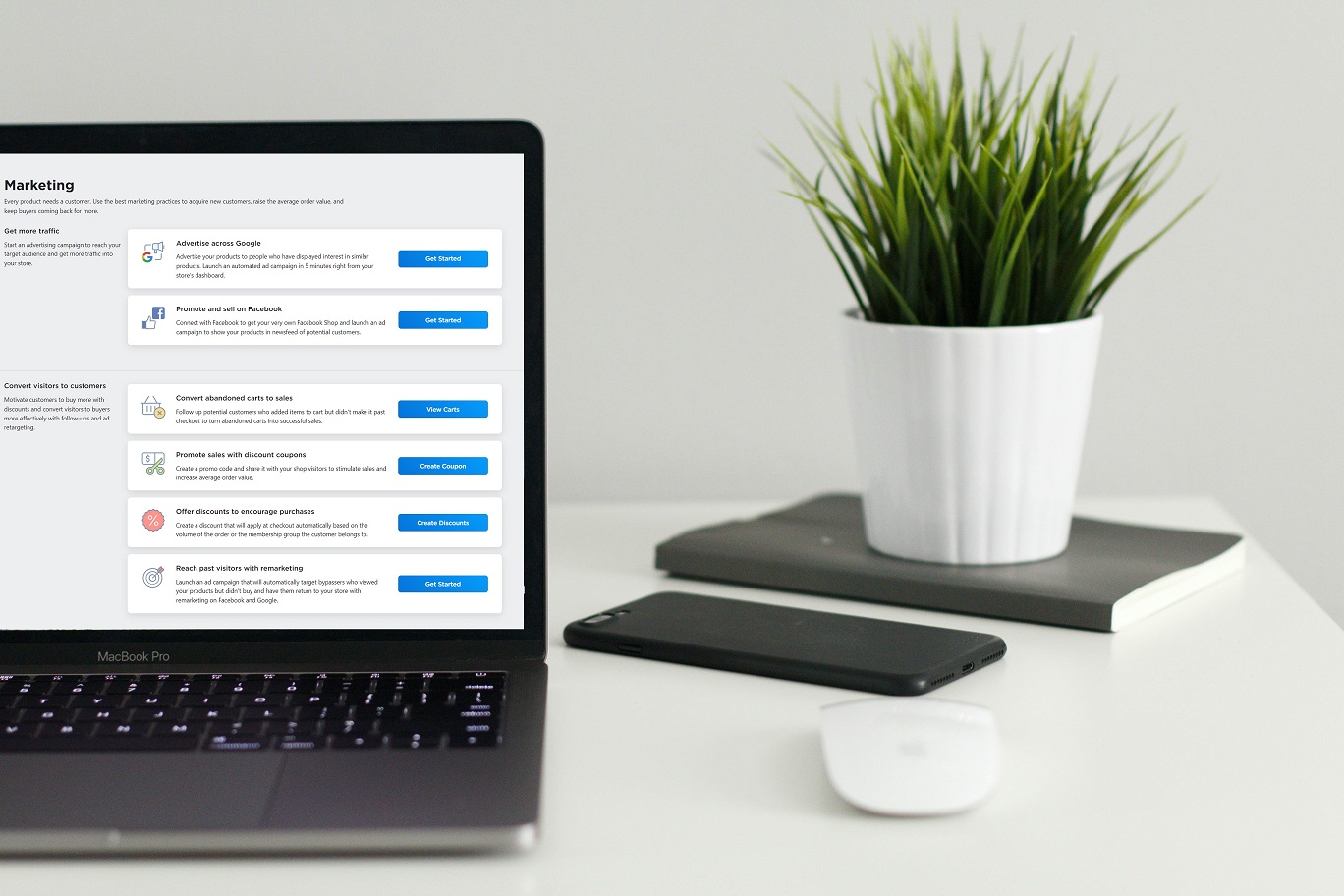

While an optimized ecommerce store is essential for selling your products, you still need a good marketing plan to get your online business off the ground.

Discover the best POS systems for small retail businesses. Learn how to streamline inventory, boost sales, and improve customer service with the right POS solution.

Learn what card testing fraud is, how it targets your e-commerce site, and the best practices you can use to detect, block, and prevent attacks before they impact your business.