Are you finding that your customers are abandoning their carts? Are your reminder emails being left unopened? Wondering why? Perhaps your customers are finding it difficult to make a large purchase in one go and would prefer a more flexible option.

Moneris merchants can now offer their customers a payment solution that allows them to split their payments up into monthly installments. The option is called Installments Enabled by Visa and is available through Moneris.

What is Buy Now, Pay Later (BNPL)?

BNPL lets your customers split their purchases into smaller, manageable payments. This can make your products more accessible and provide a secure, flexible way to pay. Imagine someone admiring a new piece of furniture on your website but hesitating due to the price. BNPL removes that barrier by offering them flexible monthly payment installments split across a defined payment schedule, for example, three or six months.How Does Installments Enabled by Visa Work with Moneris?

- Easy Setup: If you use Moneris as your payment processor, you can easily configure Installments Enabled by Visa through the Moneris Go Portal. No need for complex integrations or new accounts.

- Flexible Plans: You choose which installment options you want to offer, such as three, six, or 12-month payments. This lets you tailor your installment options to your products and target audience.

- Seamless Customer Experience: When a customer selects an installment plan at checkout, Moneris sends the details securely to Visa for verification. Visa then confirms everything with the customer's bank and lets you know the purchase is approved. The customer gets their desired product, and you get paid for the entire purchase upfront.

- No additional setting up process: This is easy for the customer, as they can pay with the credit they already have on their eligible credit card. If their purchase qualifies for installments, they can select their plan from the available options and agree to the terms. There are no new credit checks, no approvals, and no fuss. It is offered by their participating financial institution.

See BNPL in action: Transat Now Offers Installments Enabled by Visa on Vacations

BNPL extends beyond tangible goods and services and can be used in endless ways, including toward a tropical escape or a European adventure.Transat2, a leader in Canadian vacation packages, has enabled Installments Enabled by Visa to empower its customers to make their dream vacation more accessible. Here’s how you can see it in action:

How Does Installments Enabled by Visa Work with Transat?

1. Find Your Perfect Package: Surf Transat's website for a wide variety of vacation packages, from all-inclusive resorts to exciting weekend getaways.

2. Look for the Installments Enabled by Visa Option: During checkout, you'll see the Installments Enabled by Visa option if an eligible Visa or Mastercard credit card is used.

3. Choose Your Payment Plan: Select the monthly installment plan that fits your budget.

4. Enjoy Stress-free: Once your plan is confirmed, you can pack your bags and get ready for your vacation. Transat takes care of the rest, and you'll make your installment payments directly to your credit card issuer.

Customer Benefits of Using Installments Enabled by Visa with Transat:

Using this travel example, you can see how Transat enabling Installments Enabled by Visa makes it easier for their customers to take that trip now and enjoy the following benefits:

- Spread the Cost: Makes a large purchase more affordable by splitting the cost into smaller, manageable payments over a pre-defined period of time.

- Budgeting Made Easy: Allows the customer to know their exact monthly payment so they can plan their finances more effectively.

- Enjoy Now, Pay Over Time: Their customers can book their vacation today and relax, knowing the payments are spread out over time.

- Flexible Options: Merchants can offer a variety of installment plan options so that their customers can choose the plan that best suits their budget. Merchants can offer interest-free installments if they are willing to subsidize the cost. The other option is for customers to pay the interest.

Attract More Customers with BNPL

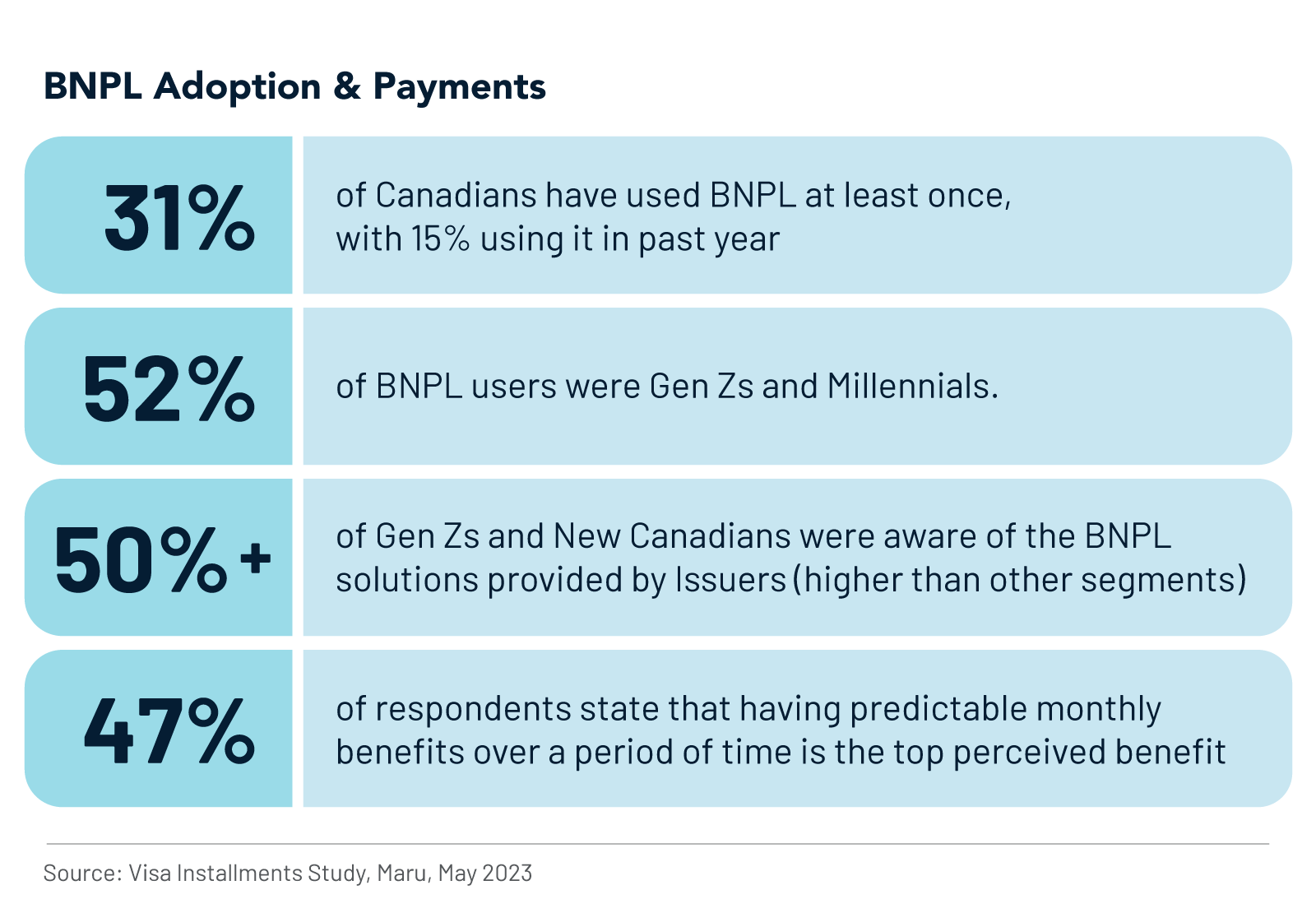

BNPL is more common than you think. It has become particularly popular among Gen Z and Millennials for several reasons. Visa conducted a survey in May 2023 which suggests that 52% of BNPL users were Gen Z and Millennials.

Here's why:

- Interest-free Payments: Unlike traditional credit cards with potentially high-interest rates, BNPL often offers interest-free payment periods. For example, imagine a Gen Z student looking for a new laptop for university. With BNPL, they can split the cost into three-monthly installments or more, while still getting the laptop immediately.

- Control and Budgeting: BNPL breaks down purchases into fixed installments, allowing for easier budgeting. Imagine a recently promoted Millennial shopping for an upgraded business wardrobe. Knowing they'll pay a set amount over the next few months helps them manage their finances and avoid surprises on their credit card statement while empowering them to step into their new role with confidence.

- Convenience and Transparency: BNPL options are often integrated directly into the checkout process. This one-click convenience is very appealing to tech-savvy generations. For instance, imagine a Gen Z shopper buying concert tickets. Seeing the BNPL option at checkout allows them to secure their spot without the hassle of filling a separate application.

- Build Credit History: Some BNPL services report on-time payments to credit bureaus, which can help young adults build their credit history responsibly. This is attractive to Gen Z and Millennials looking to build or improve their credit history. A young professional using BNPL for smaller purchases and paying on time allows them to establish a positive credit history that can help them secure loans in the future, such as a mortgage to buy a house.

Benefits of Offering BNPL at Your Business:

With the popularity of BNPL on the rise, merchants are enjoying the benefits of offering a payment option that empowers customers and boosts sales.

- Increased Sales: Research commissioned by Visa suggests that 39% of customers would be less likely to abandon their shopping cart if installment plans were available at a merchant.* This can lead to higher average order values and more conversions at checkout.

- Attract New Customers: BNPL appeals to budget-conscious customers and can help you reach a wider audience.

- Improved Cash Flow: You receive the full purchase price upfront, regardless of the customer's payment schedule.

- Customer Loyalty: According to research commissioned by Visa, 34% of consumers would be more likely to purchase again at stores that provide installment plans*. This can help you get repeat purchases and foster customer loyalty.

*Source: Visa Installments Study, Maru, May 2023.

To get started, contact sales here.

_______________________________________________________________________________

1- https://www.visa.ca/en_CA/partner-with-us/payment-technology/installments.html

2- https://www.transat.com/en-CA/book/how-can-i-pay/installments-enabled-by-visa

Article filed under:

growth strategiesShare