Taxable Fees Report

The Taxable Fees report shows merchants the taxes accrued on the fees they pay to Moneris for device rental, Interac Online, Service fees, etc. This report has three variants: Tax Breakdown by Chain, Tax Summary by Province, and Tax Breakdown by Province, and can be run at the superchain level. The merchant and chain level do not have these variants and only offer a Taxable Fees report.

Why use this report

This report will help you determine:

- For superchains, you can see the fees and taxes paid on those fees, broken down by province in which your chains operate.

- A summary of the taxes paid on fees in each province for the merchant, chain, or superchain.

- A detailed view of the taxes paid on fees in each province for the merchant, chain, or superchain.

- Fee amounts incurred in each province in which your business operates.

Module customization

The module results can be customized in the following ways:

Module options

You can run this report for:

- Merchant level (one Merchant ID)

- Chain level (multiple Merchant IDs)

- Superchain level (multiple Merchant IDs)

The sections below explain how to generate the various reports and what data you will see.

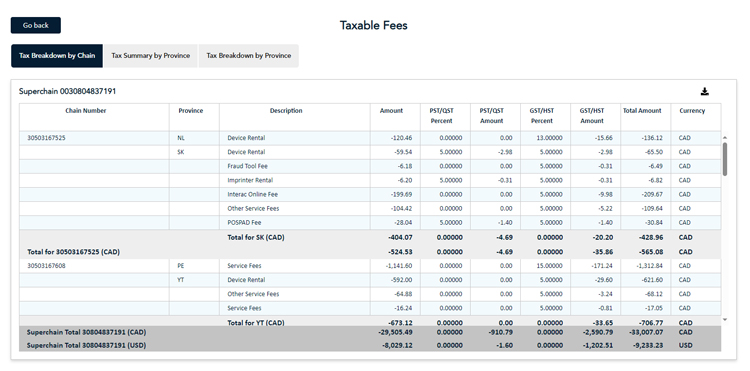

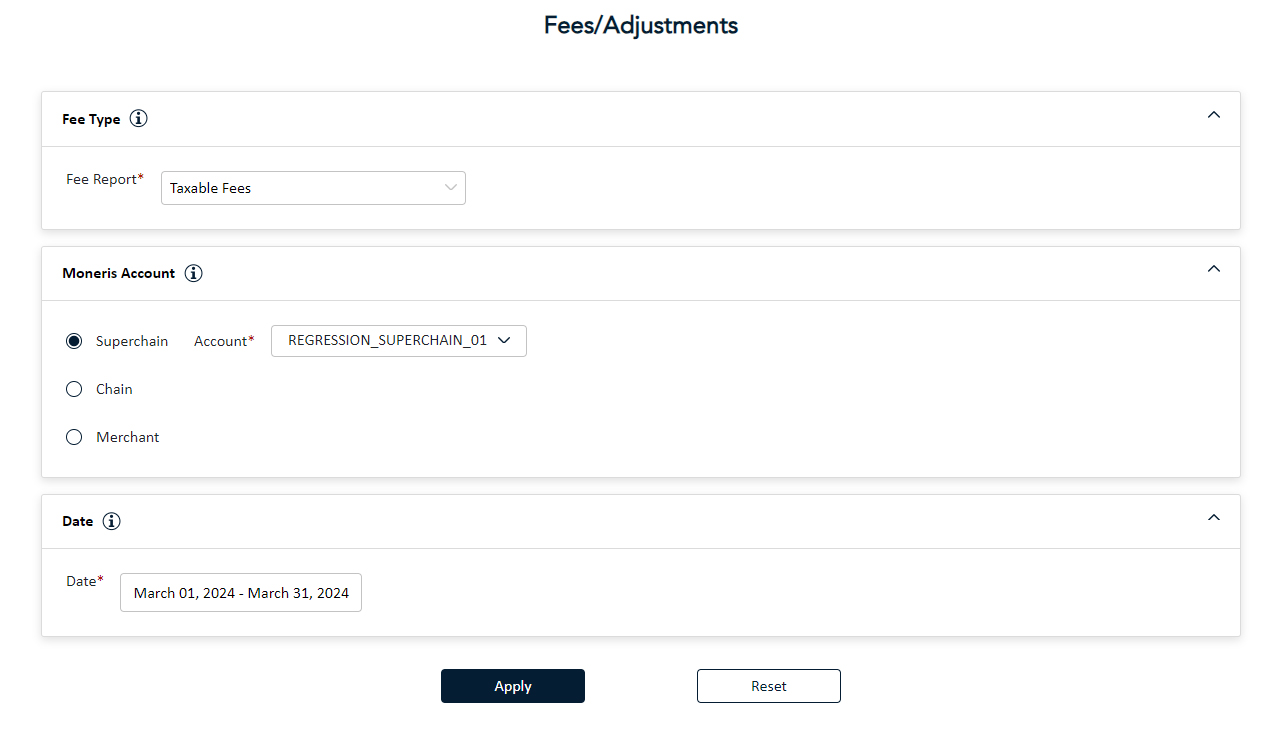

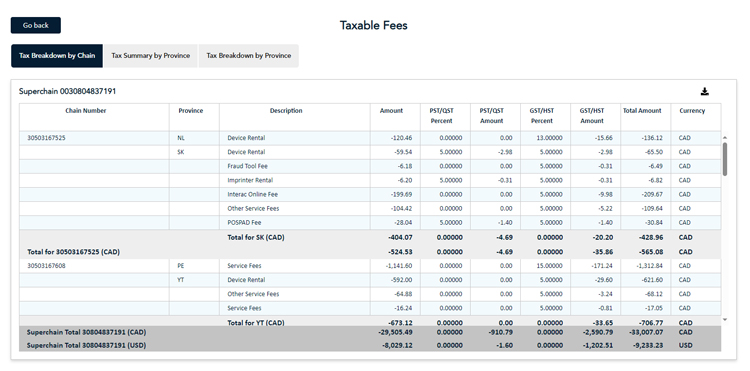

Generate the Tax Breakdown by Chain report

Note: This report is only available for superchain merchants. Single store and chain merchants will not be able to generate this report.

To generate the Tax Breakdown by Chain report, do the following:

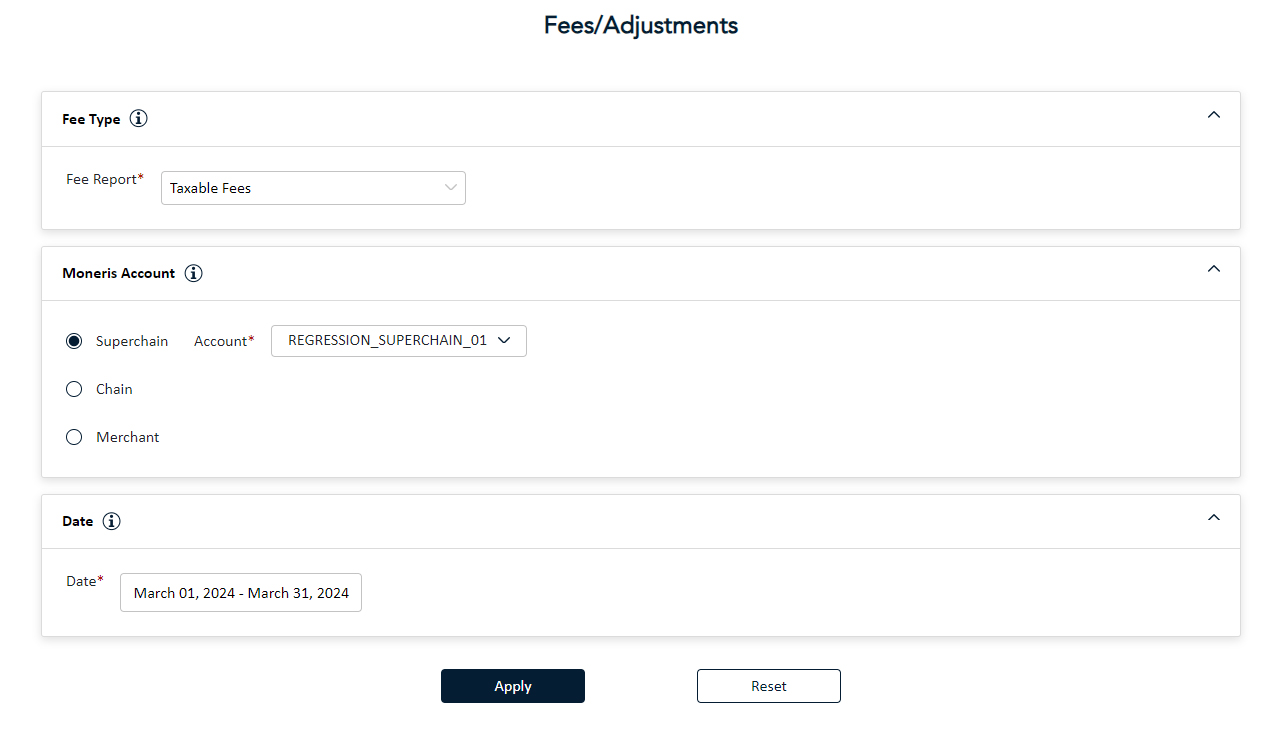

- From the main menu, under the Reports section, click Fees/Adjustments. The Fees/Adjustments screen appears.

- In the Fee Type section, click the Fee Report drop-down menu and select Taxable Fees.

- In the Moneris Account section, select the superchain account you wish to report on.

- In the Date section, click the Date drop-down menu and select the year and month on which you wish to report.

- Click the Apply button at the bottom of the screen. The report appears.

- Make sure the Tax Breakdown by Chain option at the top of the screen is selected.

Available dates for the report

The report is able to be run for a date range of 366 days, up to two years in the past.

Field and section description

Refer to the descriptions of all of the sections that are available for this report.

Note: Field names are listed alphabetically on this page only to assist you with quick lookup and identification.

- Amount - This field displays the total fee amount levied for each fee within the specified date range.

- Chain Number - This field displays the chain number which incurred the fees.

- Currency - This field displays the currency type (CAD or USD) of the fees.

- Description - This field shows the description of the fee program which incurred the taxes.

- GST/HST Amount - This field displays the total amount of GST/HST collected on the fees incurred within the specified date range.

- GST/HST Percent - This field displays the GST/HST rate levied against the fees.

- Province - This field displays the two digit short form of the province in which the chain operates.

- PST/QST Amount - This field displays the total amount of PST/QST collected on the fees incurred within the specified date range.

- PST/QST Percent - This field displays the PST/QST rate levied against the fees.

- Total Amount - This field displays the total amount of the fees against which the taxes were levied.

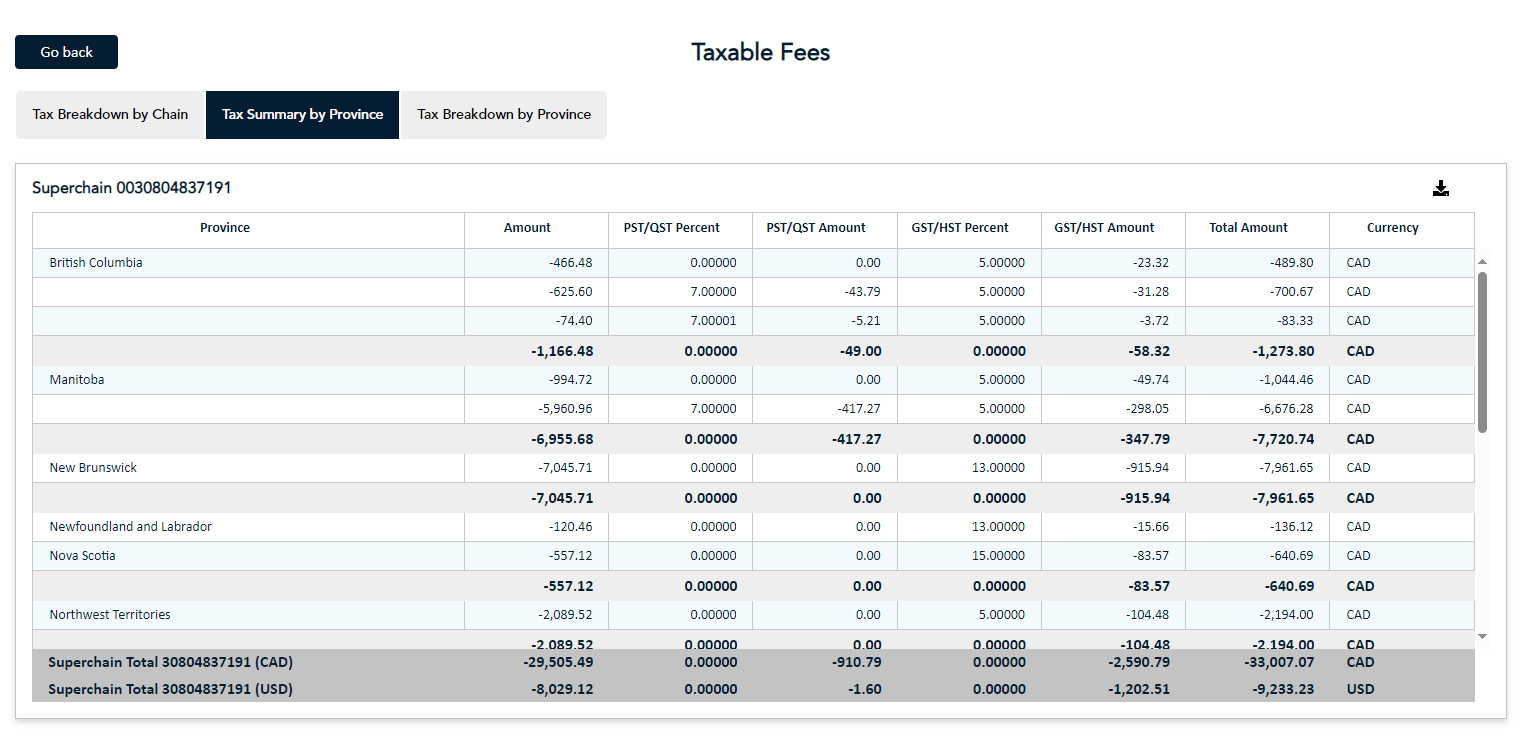

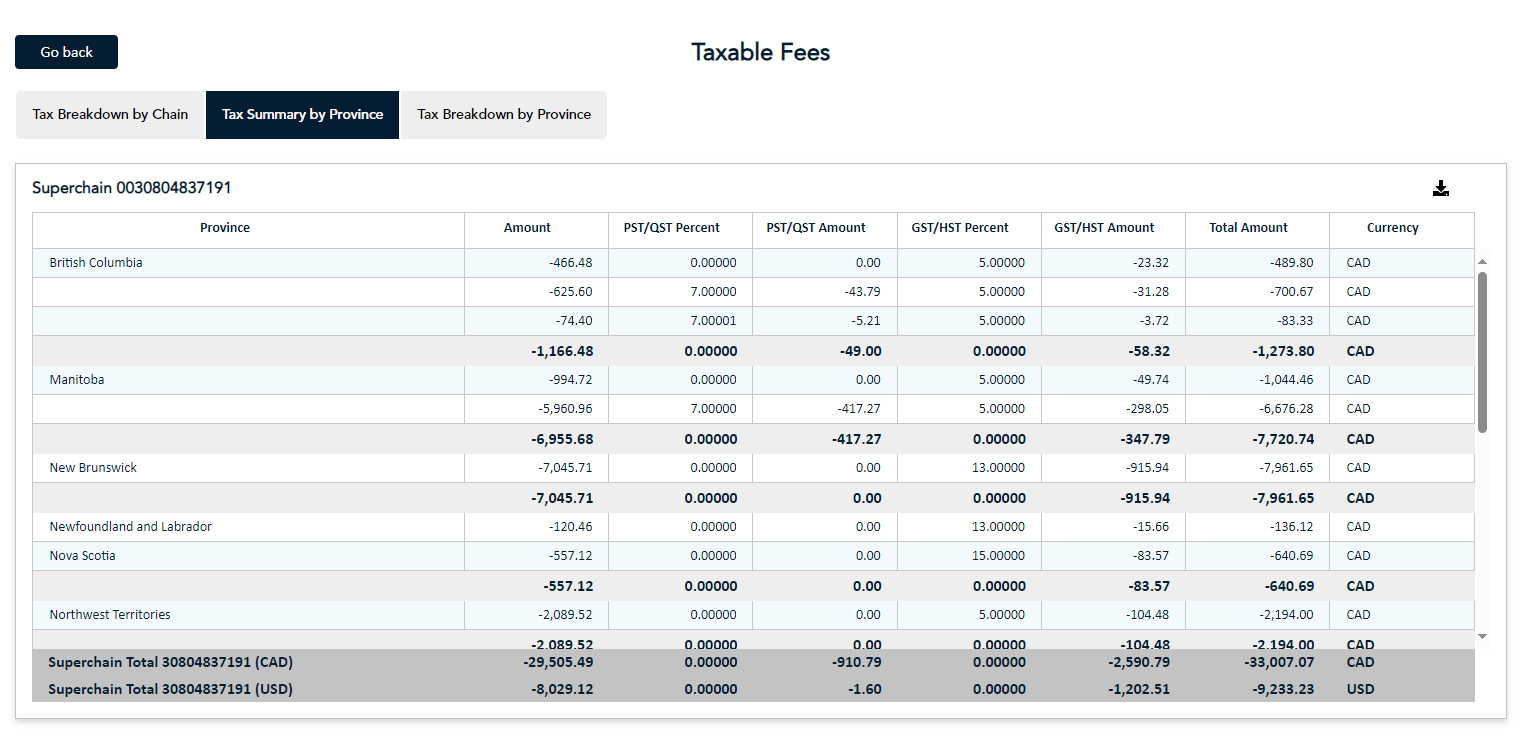

Generate the Tax Summary by Province report

To generate the Tax Summary by Province report, do the following:

- From the main menu, under the Reports section, click Fees/Adjustments. The Fees/Adjustments screen appears.

- In the Fee Type section, click the Fee Report drop-down menu and select Taxable Fees.

- In the Moneris Account section, select the superchain account you wish to report on.

- In the Date section, click the Date drop-down menu and select the year and month on which you wish to report.

- Click the Apply button at the bottom of the screen. The report appears.

- Make sure the Tax Summary by Province option at the top of the screen is selected.

Available dates for the report

The report is able to be run for a date range of 366 days, up to two years in the past.

Field and section description

Refer to the descriptions of all of the sections that are available for this report.

Note: Field names are listed alphabetically on this page only to assist you with quick lookup and identification.

- Amount - This field displays the total fee amount levied within the specified date range.

- Currency - This field displays the currency type (CAD or USD) of the fees.

- GST/HST Amount - This field displays the total amount of GST/HST collected on the fees incurred within the specified date range.

- GST/HST Percent - This field displays the GST/HST rate levied against the fees.

- Province - This field displays the two digit short form of the province in which the chain operates.

- PST/QST Amount - This field displays the total amount of PST/QST collected on the fees incurred within the specified date range.

- PST/QST Percent - This field displays the PST/QST rate levied against the fees.

- Total Amount - This field displays the total amount of the fees against which the taxes were levied.

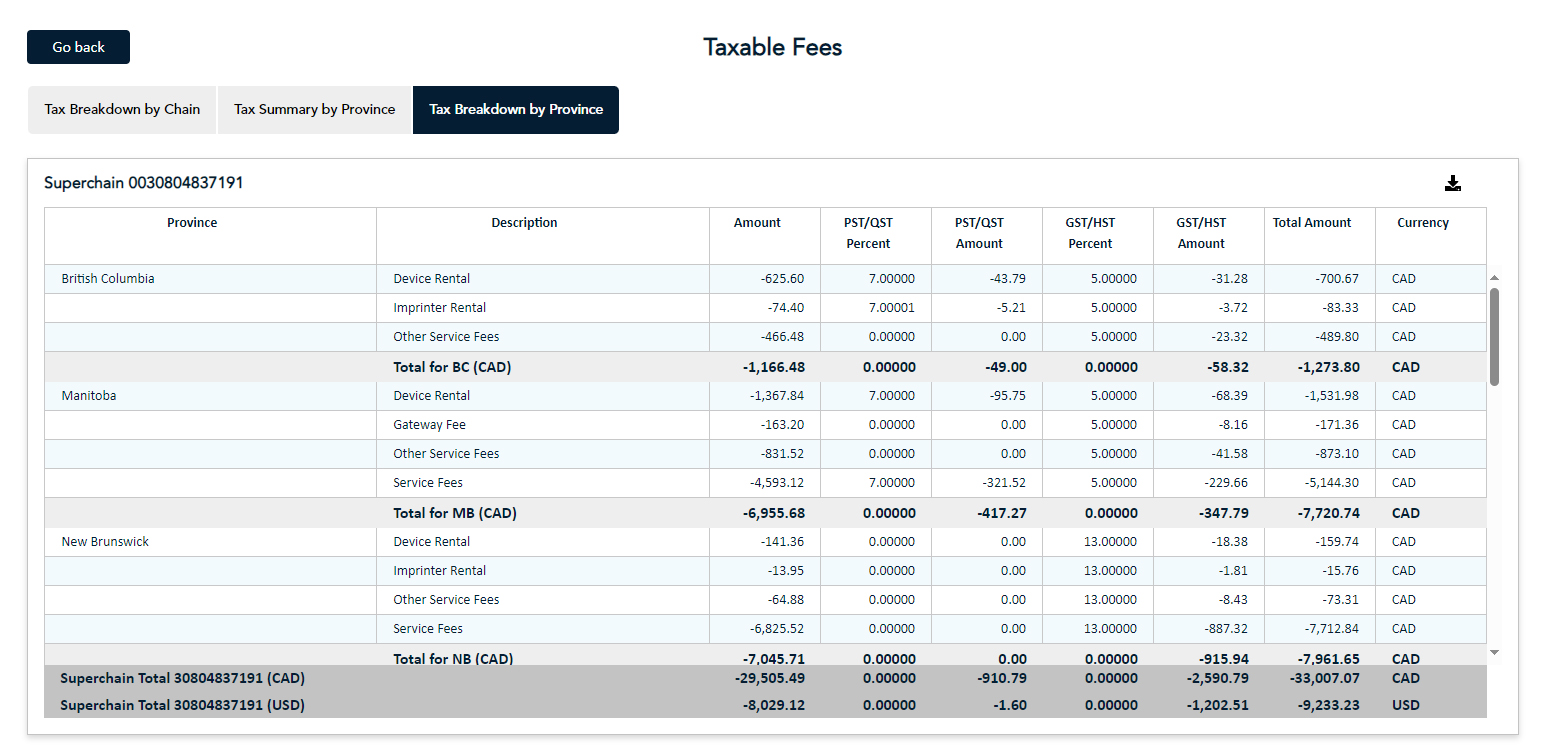

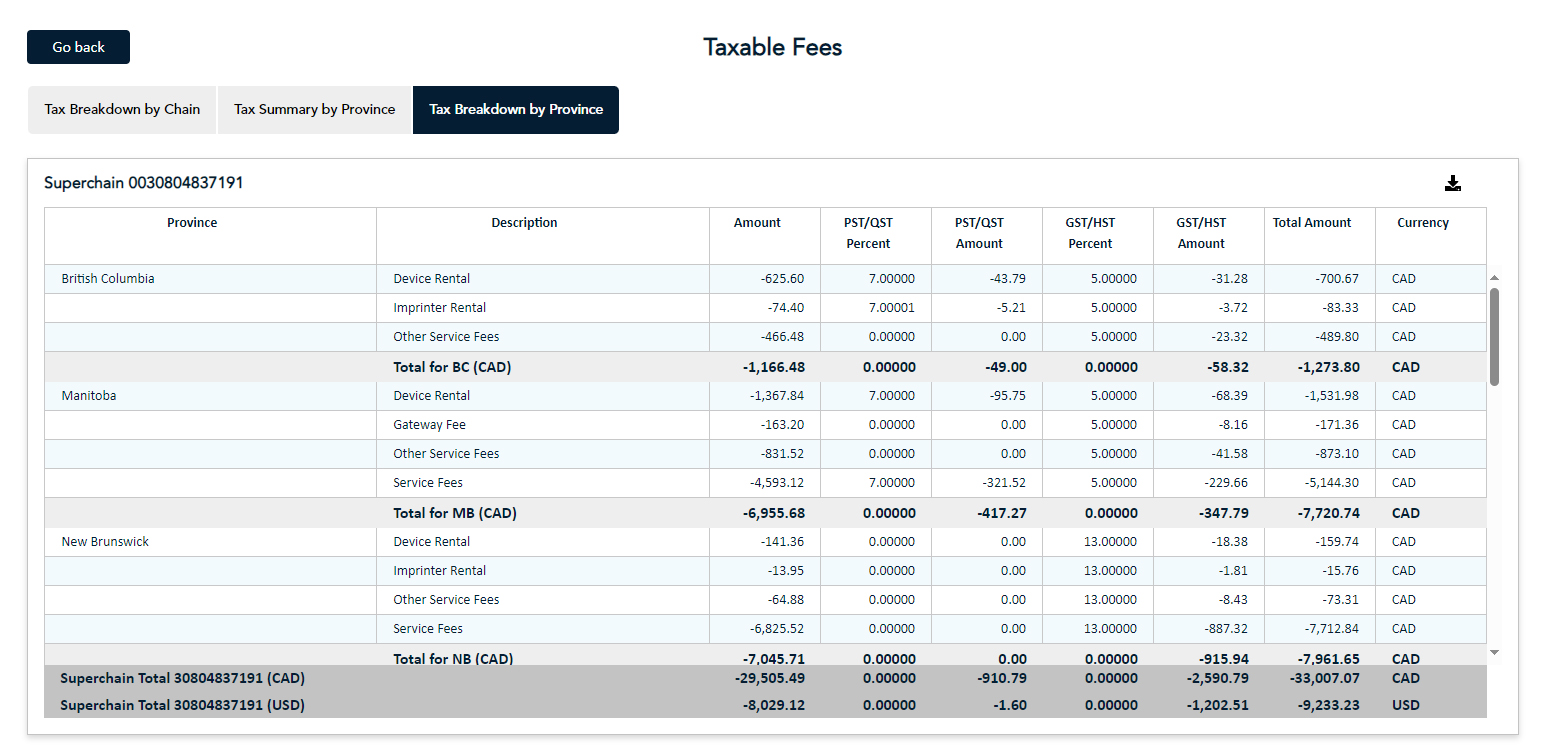

Generate the Tax Breakdown by Province report

To generate the Tax Breakdown by Province report, do the following:

- From the main menu, under the Reports section, click Fees/Adjustments. The Fees/Adjustments screen appears.

- In the Fee Type section, click the Fee Report drop-down menu and select Taxable Fees.

- In the Moneris Account section, select the superchain account you wish to report on.

- In the Date section, click the Date drop-down menu and select the year and month on which you wish to report.

- Click the Apply button at the bottom of the screen. The report appears.

- Make sure the Tax Breakdown by Province option at the top of the screen is selected.

Available dates for the report

The report is able to be run for a date range of 366 days, up to two years in the past.

Field and section description

Refer to the descriptions of all of the sections that are available for this report.

Note: Field names are listed alphabetically on this page only to assist you with quick lookup and identification.

- Amount - This field displays the total fee amount levied for each fee within the specified date range.

- Currency - This field displays the currency type (CAD or USD) of the fees.

- Description - This field shows the description of the fee program which incurred the taxes.

- GST/HST Amount - This field displays the total amount of GST/HST collected on the fees incurred within the specified date range.

- GST/HST Percent - This field displays the GST/HST rate levied against the fees.

- Province - This field displays the two digit short form of the province in which the chain operates.

- PST/QST Amount - This field displays the total amount of PST/QST collected on the fees incurred within the specified date range.

- PST/QST Percent - This field displays the PST/QST rate levied against the fees.

- Total Amount - This field displays the total amount of the fees against which the taxes were levied.