- On the main menu, click Settings, then Store.

- On the Store settings page, scroll down to Tax settings.

- If you have your tax registration number ready, click Yes, I am eligible to collect taxes.

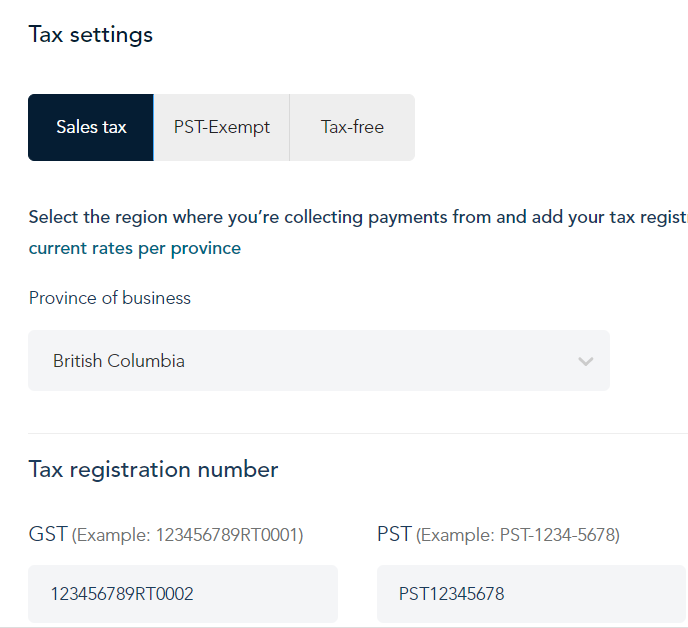

- Under Sales tax, select your Province of business.

- Under Tax registration number, enter the information required. This will vary by province. You may be asked to enter a registration number for one or more of these taxes: GST, PST, HST, RST, or QST.

- When prompted to confirm the tax rate, click checkbox next to "I agree".

- Click Save.

- If you sell products that are exempt from PST, continue to step 9. If you sell products that are exempt from all taxes, continue to step 10.

Note: When adding a product or editing a product, you can also indicate the product is PST-exempt or tax-free.

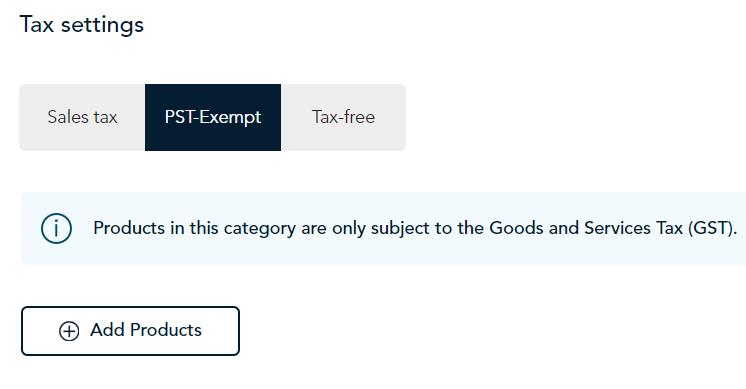

- To specify which products are exempt from provincial sales tax (PST):

- Click the PST Exempt tab.

- Click Add products.

- When the product panel appears, select the products or categories to which Go Retail should not apply the PST, then click Save.

- The panel closes and the products you selected will appear on the PST Exempt tab. When you sell these products, Go Retail will apply the GST only.

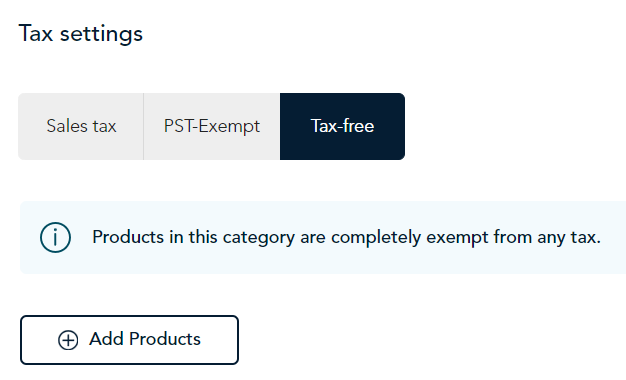

- To specify which products are exempt from all taxes:

- Click the Tax-free tab.

- Click Add products.

- When the product panel appears, select the products or categories to which Go Retail should not apply any tax, then click Save.

- The panel closes and the products you selected will appear on the Tax-free tab. When you sell these products, Go Retail will not apply any taxes.