Create tax profiles

|

The tax information provided in this article are examples only and are not intended to constitute tax advice or guidance or to otherwise apply to your circumstances or requirements. You solely are responsible for determining the correct goods, sales, harmonized and other tax rates to be applied as part of your transactions with your customers. We are not engaged in rendering tax, accounting, legal or other professional advice or service. If accounting advice or other expert advice is required, the service of a competent professional should be sought.

|

In order to calculate the correct payment for orders, you must create one or more tax profiles for your restaurant using the taxes that apply in your province. In the Go Restaurant portal, first add the individual taxes that apply to your products, then create the tax profiles. Once you create the tax profiles, you can assign them to your menu categories.

Add individual taxes

Begin by adding the individual taxes that apply to your products, based on the province in which you are operating.

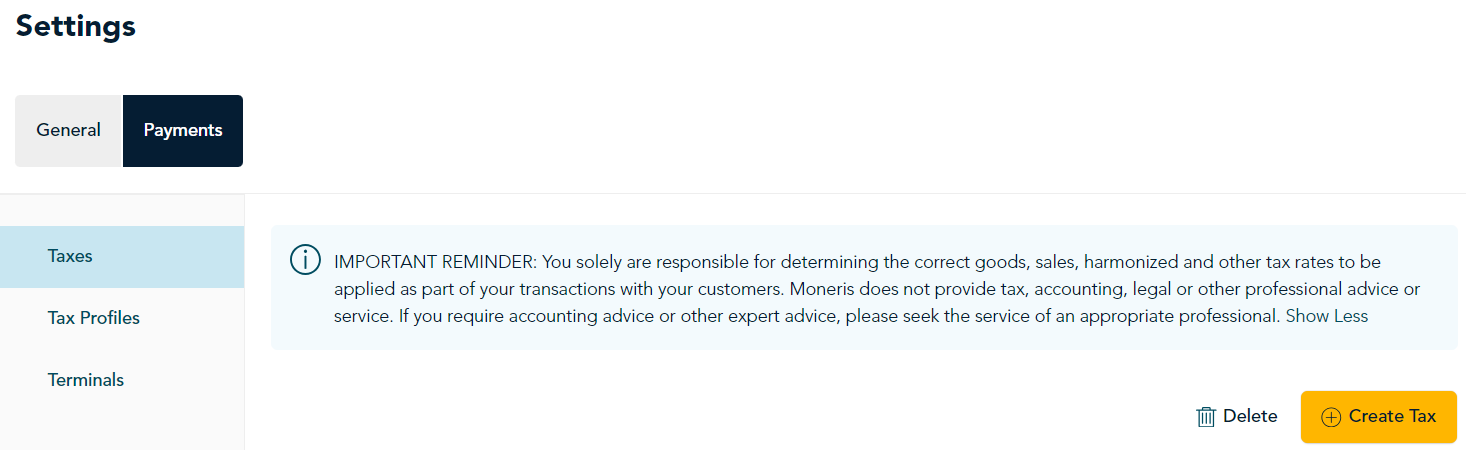

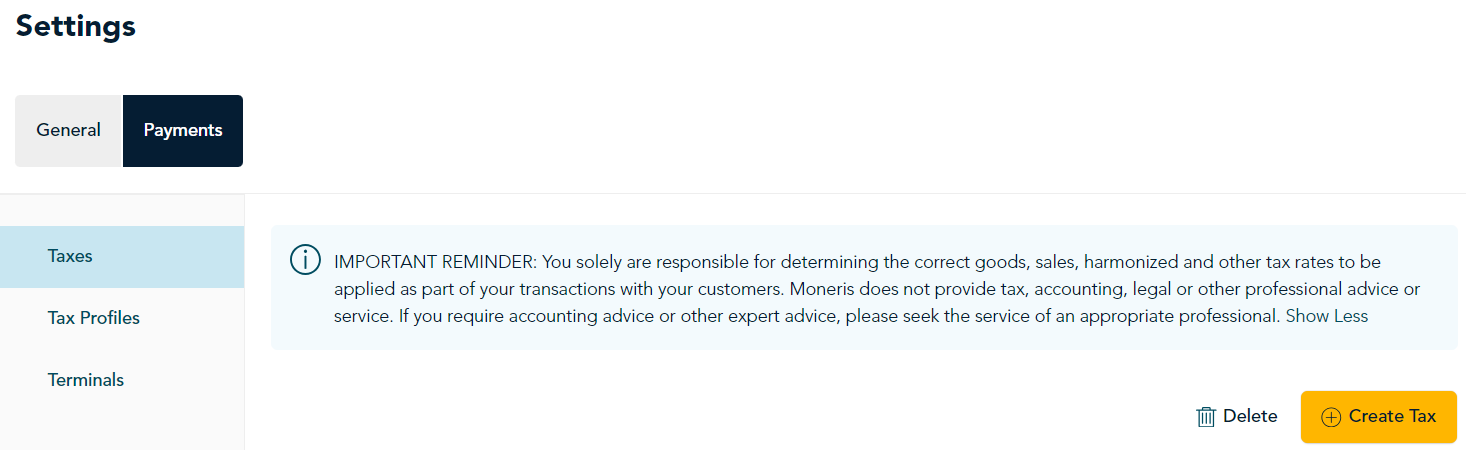

- In the portal, click Settings on the main menu.

- On the Settings screen, click Payments. The portal displays the screen for Taxes.

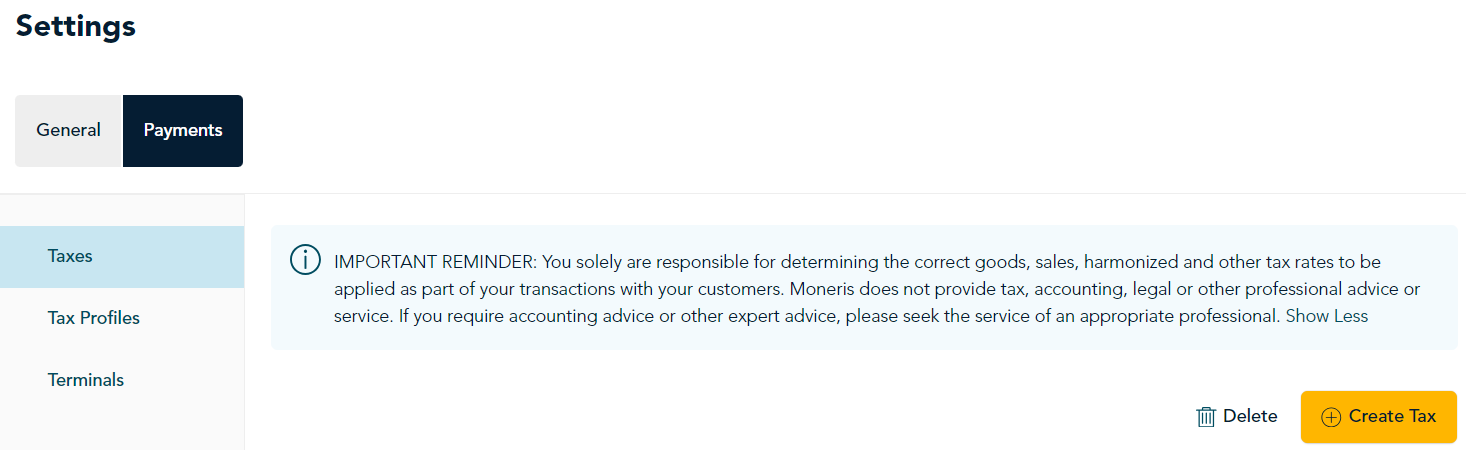

- Click the Taxes tab, then click Create Tax.

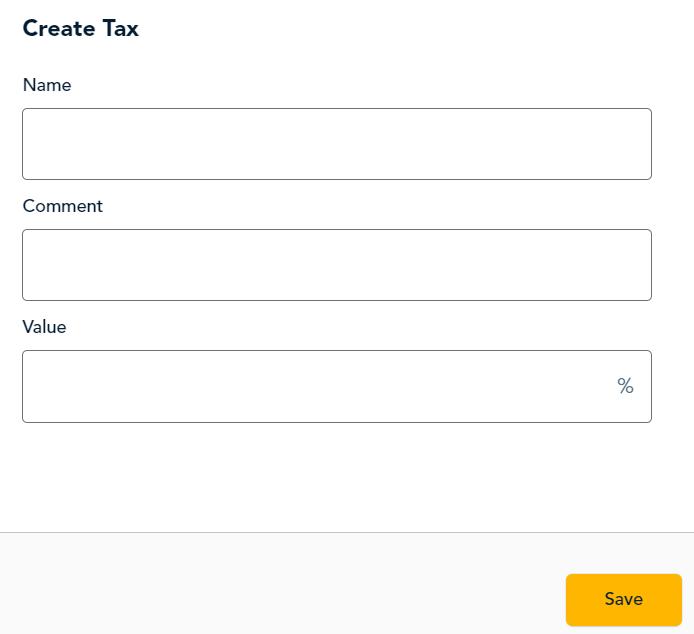

- When the "Create Tax" panel appears:

- Enter a name for the tax. Here are some examples: PST, GST, HST.

- Enter any comments you wish to include. The comments field is optional. Use it to briefly describe the tax.

- Enter the percentage value of the tax.

- Click Save. The Taxes page reappears showing the tax you just created.

- Repeat these steps to create all of the individual taxes that apply to your products.

Create tax profiles

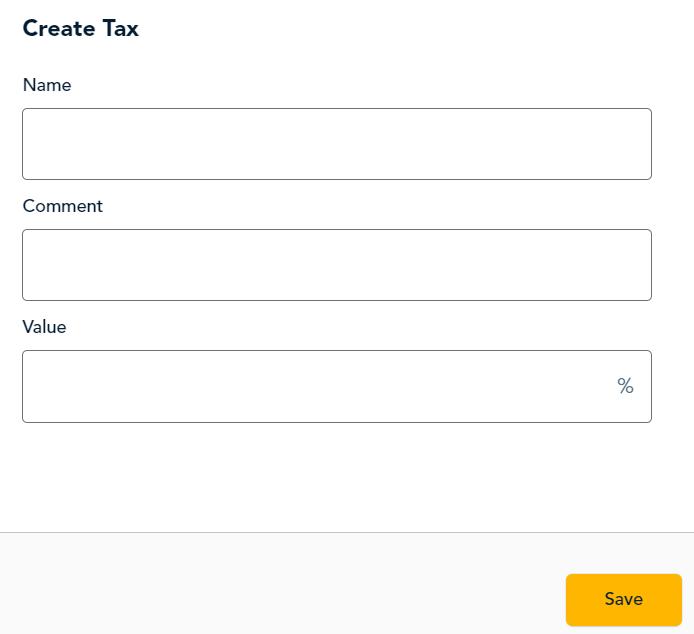

After adding the individual taxes to the portal, you can now create your tax profiles.

Note: How many tax profiles should you create? You must create a tax profile for each tax scenario that applies to your restaurant. In most cases, one tax profile may be enough to cover food and beverages. You can create additional tax profiles for specific products. For example, if you are operating in British Columbia, the soda tax applies to sweetened, carbonated drinks but not to other drinks. Consult a tax or accounting professional if needed.

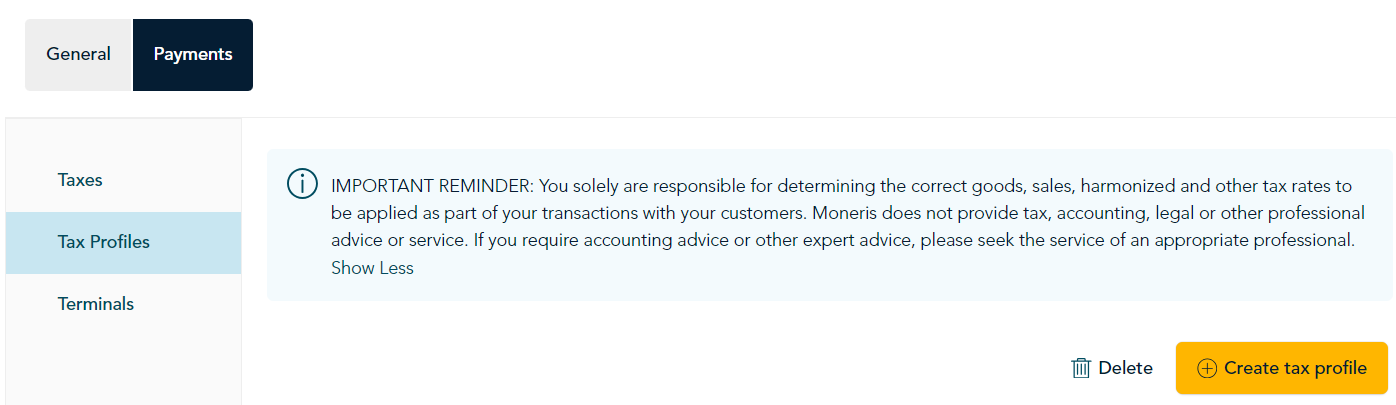

- At the left side of the screen, click Tax Profiles, then click Create tax profile.

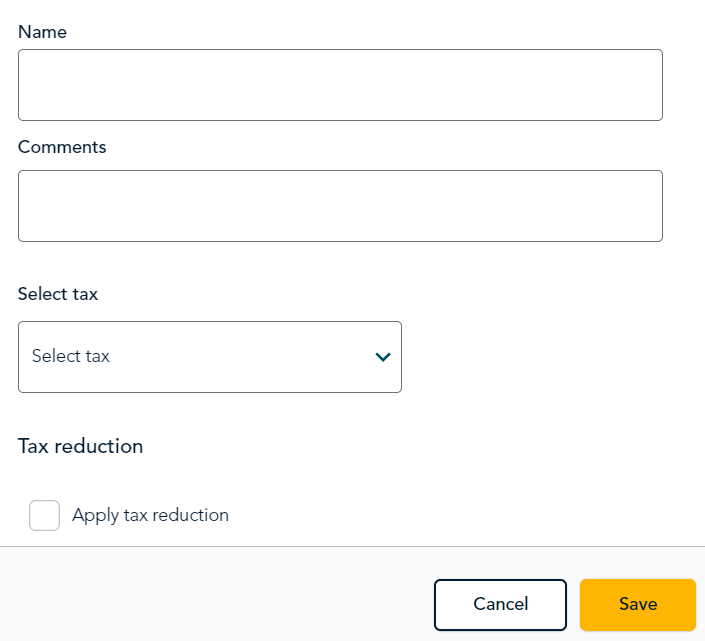

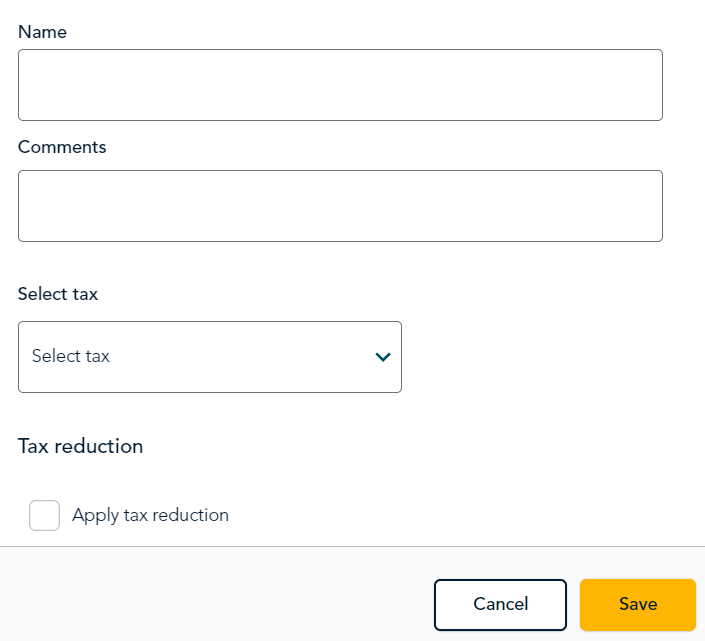

- When the "Create tax profile" panel appears:

- Enter a name for this profile, for example, Food, Drinks, Alcohol, Soda, Grocery, Retail items

- Enter any comments you wish to include. The comments field is optional. Use it to briefly describe this profile.

- Click the Select tax dropdown menu and select each individual tax you want to include in this profile. For example, to create a profile for food sales, you might select both PST and GST.

- Under Tax reduction: If you wish to specify a tax reduction for products under a specific price or quantity, click the checkbox labelled "Apply tax reduction." Complete the required fields to indicate the condition ( by taxable dollar amount or by quantity or both) and the percentage tax to charge when the condition is true. For help with tax rules, refer to federal and provincial government sources.

- Click Save. The new profile appears on the Tax Profiles screen.

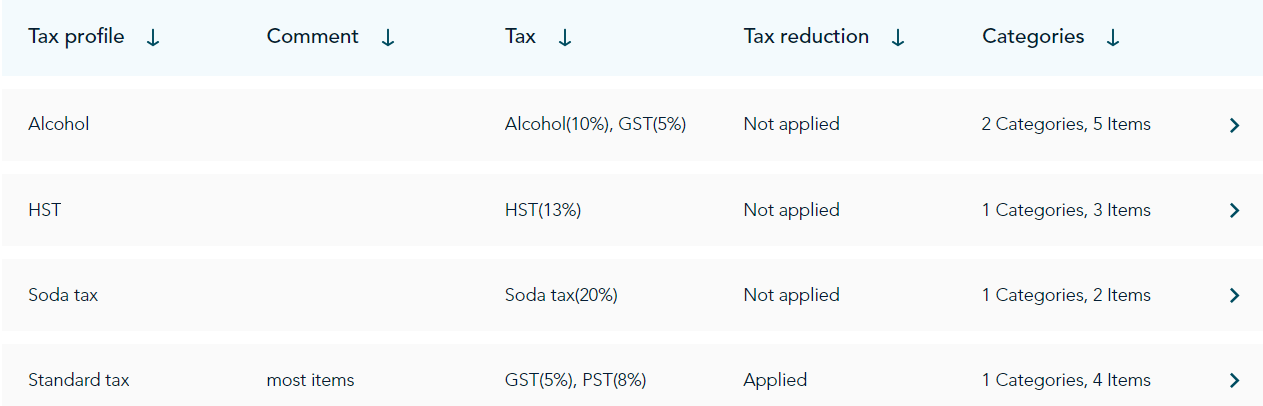

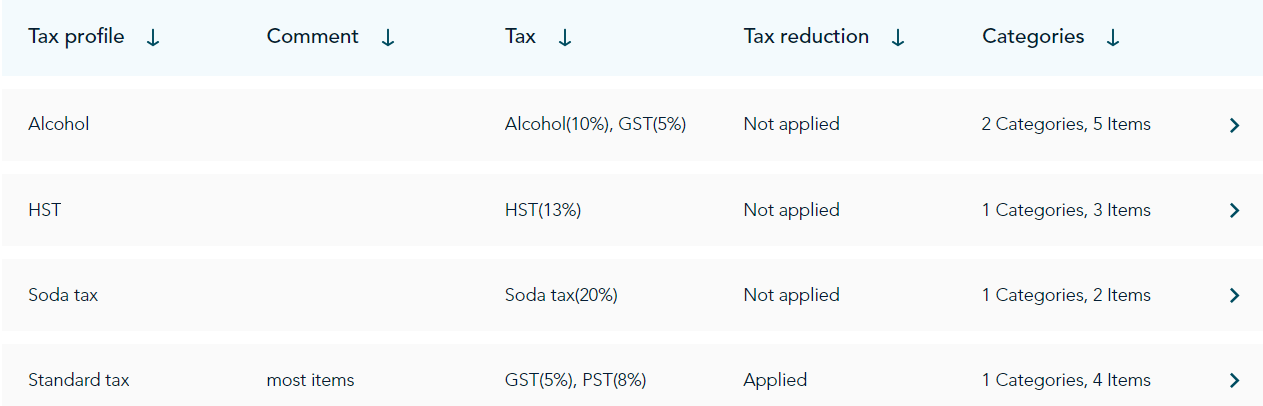

- The Tax Profiles screen shows all the tax profiles you created, including:

- any comments you added

- the individual taxes you added

- whether tax reduction was applied or not

- the number of categories and number of products to which a profile has been applied. (Note: Tax profiles are applied when you create menu categories.)

- Repeat these steps to create all of the tax profiles you will need for your products.

Return to Data setup overview to continue setting up Go Restaurant.