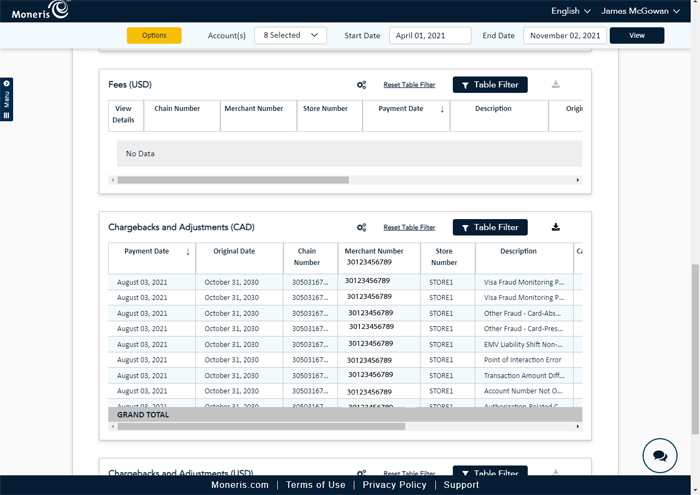

The Bank Reconciliation module provides a summary of deposits, fees accrued while conducting business, and a list of chargebacks and adjustments that occurred within a date range. Amounts for each (deposits, fees, and chargebacks) are listed in both Canadian (CAD) and US (USD) currencies.

This module will help you determine:

delayed deposit and/or deposit retention settings.

the amount of deposits that have been retained, and the current retention balance for each card type.

component charges that were aggregated together as a single fee charged to the merchant's bank account.

a complete breakdown of taxes applied to transactions and/or service fees charged to the merchant.

a breakdown of total transaction fees for each card type.

The module results can be customized in the following ways:

export results to CSV

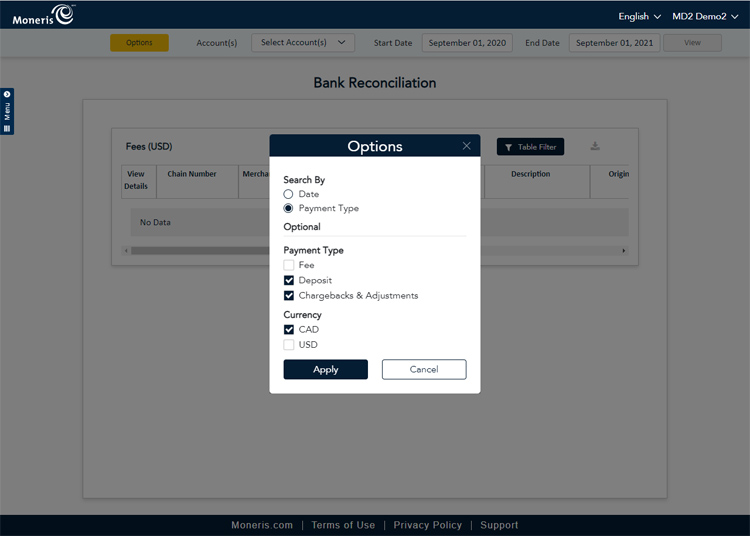

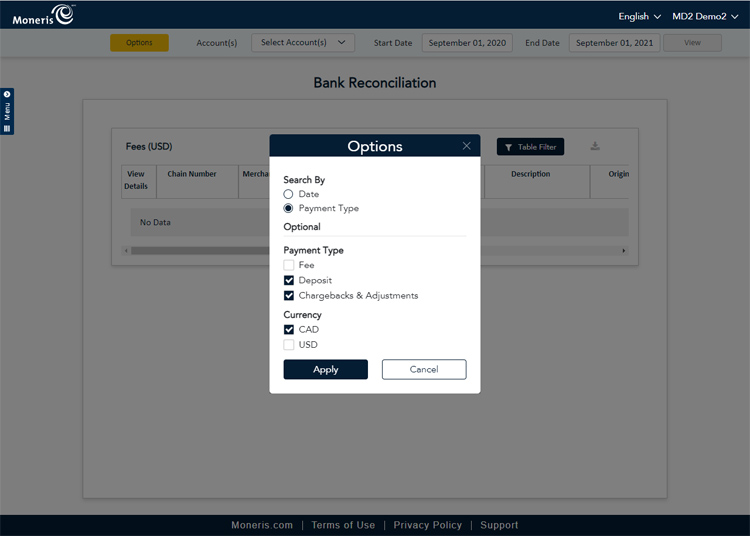

This module also features options which can change the type of data displayed on the report. These options include:

Search By Date or Payment Type - This option enables the results to be searched by and displayed sorted according to date or payment type used.

Payment Type: Fee, Deposit, or Chargebacks & Adjustments - If you search by Payment Types, you have the option to search by Fee, Deposit, and/or Chargebacks & Adjustments.

Currency: CAD or USD - This option enables you to check the currency you'd like to see on the report. If you accept payments in both CAD and USD, leave it as is, but if you only accept payment in one currency, you can check the other to hide it.

To use the options:

Click the Options button at the top of the Bank Reconciliation screen. The Options popup appears.

Set your options as follows:

Select how you would like to search for results:

Click the Date radio button to search for results by date.

Click the Payment Type radio button to search for results by payment type.

Select which sections you would like to see on the report under the Payment Type heading:

To display the Fees, Deposit, and/or Chargebacks and Adjustments sections on the report, place checkmarks in the boxes for the sections you wish to be visible.

Select which currencies you'd like to see on the report:

To display results in both currencies, leave the boxes under the Currency section checked.

If you wish to hide the results of one or the other, uncheck the desired box to hide it.

When finished selecting the report options, click the Apply button.

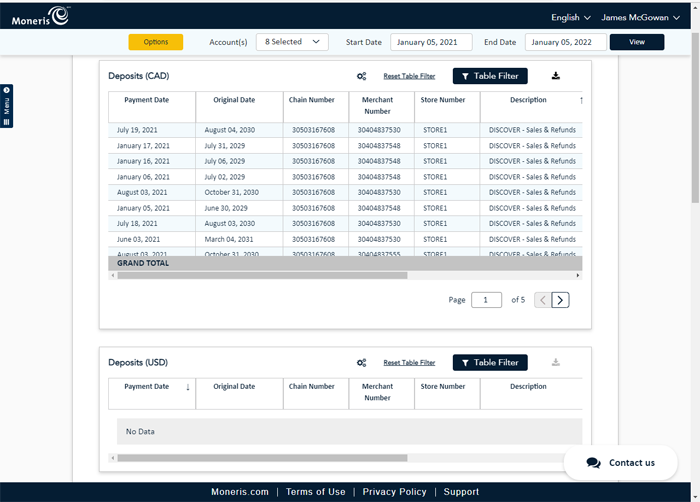

In our example above, we are going to display results grouped by payment type in Canadian funds only, and are going to exclude Fees from the report output. Here's a screenshot of what that report will look like:

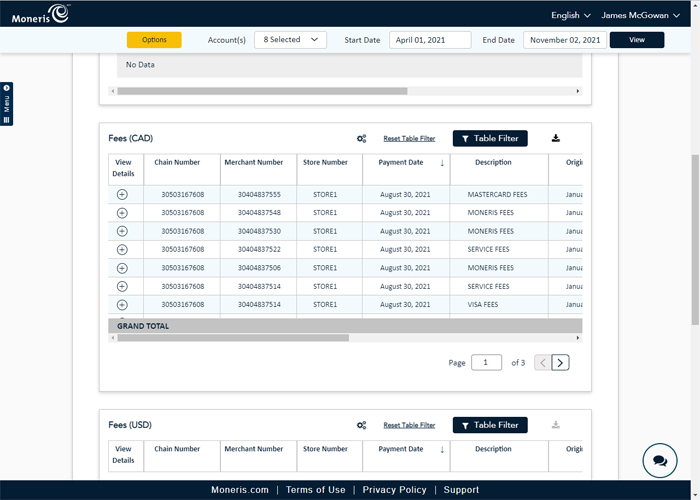

From the main menu, under the Reports section, click Bank Reconciliation. The Bank Reconciliation module screen appears.

(Optional) Set the report options as described in the Report options section above. Once finished, proceed to the next step.

In the report screen, select the account(s) on which you wish to report.

Enter a date range for the report in the Start Date and End Date field.

Click the View button. The report generates and the results appear on the screen.

The report is able to be run for a date range of 366 days, up to two years in the past.

The Deposits section is split into deposits in Canadian (CAD) and American (USD) currencies. This section is dynamic, and can display information about the payment date, merchant, chain, and store number, transaction description, settlement, retained, and payment amounts, and the bank account to which the funds were deposited.

The Fees section is split into sections for fees processed in Canadian (CAD) and American (USD) currencies. This section is dynamic, and can display information about the payment date, merchant, chain, and store number, transaction description, the transaction and tax amounts, and the bank account from which the fees are extracted.

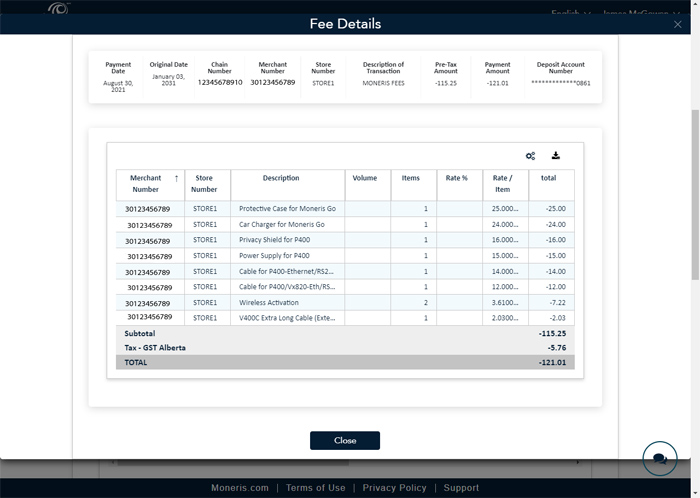

In addition to viewing the results in a report, you can view the details of the fees charged. In the Fees section, click the + symbol in the View Details column. The Fee Details screen opens and displays information about the fees incurred while conducting your business.

Note: Fees appearing here are presented as a single charge. This single charge represents the aggregated total of the component charges. For example, asingle charge titled 'Moneris Fees' might incorporate any hardware and peripherals you have ordered within the date range, as demonstrated in the example below.

The Chargebacks and Adjustments section is split into chargebacks and adjustments processed in Canadian (CAD) and American (USD) currencies. This section is dynamic, and can display information about the payment date, merchant, chain, and store number, a chargeback/adjustment description, card type and reason code, case ID, payment amounts, and the bank account to which funds were deposited.